How to get an AUD IBAN in the UAE | Hubpay for UAE-Australia trade

Discover how UAE businesses trading with Australia can open a named AUD IBAN with Hubpay, receive payments seamlessly, and scale faster with top FX rates.

Published on 2 July 2025

3 min read

How to get a AUD IBAN in 1 business day | Hubpay for UAE-Australia Trade

Trade between the United Arab Emirates and Australia continues to grow rapidly. In 2023, two-way trade between both nations reached $9.9 billion, with sectors like agriculture, manufacturing, energy, and professional services driving economic activity. Source: Austrade

In November 2024, the UAE and Australia signed a Comprehensive Economic Partnership Agreement (CEPA), eliminating tariffs on over 99% of Australian exports and creating more certainty for service providers in over 120 sectors. Source: UAE Times

As economic ties deepen, UAE businesses working with Australian partners need efficient banking tools to support fast, cost-effective payments. This is where a named AUD IBAN becomes essential.

What Is an AUD IBAN and why do UAE businesses need one?

An AUD IBAN (International Bank Account Number in Australian Dollars) is a bank account identifier that enables your business to receive and send AUD payments from clients, partners, and suppliers in Australia. It supports local and international payment rails, reducing intermediary fees and delays.

Not sure what an IBAN is? Read this helpful guide from Wise or Revolut.

Why AUD IBANs matter for UAE businesses?

Eliminate delays in receiving AUD payments from Australian partners

Avoid conversion losses with intermediary banks and third-party FX providers

Build trust with Australian suppliers and clients with a dedicated, named IBAN

Operate efficiently with real-time access to balances and FX

Example of a Hubpay AUD IBAN:

How can AUD IBANs help UAE businesses scale quickly?

With a named AUD IBAN, businesses in the UAE can:

Receive AUD payments directly from Australian partners with no hidden fees

Hold AUD in wallet for future use or convert at optimal times

Convert instantly to AED, USD or 150+ currencies using best FX rates

Reduce costs and improve cash flow with better margins on every transaction

Make outward payments in AUD for vendor and supplier payouts

This is especially beneficial for:

General Trading Companies importing Australian goods like meat, grains, and wine

Professional Services Firms dealing with Australian clients in education, legal, or consulting

Logistics and Freight Businesses managing supply chains between the UAE and Australia

Retailers and E-commerce Brands selling high-value Australian goods in the UAE

The Hubpay advantage: Built for speed and scale

Unlike traditional banks that require minimum balances, long onboarding, and credit approvals, Hubpay offers:

Named AUD IBANs issued under your business name

Account setup within 1 business day

Zero minimum balance requirements

Easy onboarding through a digital portal

Secure platform regulated in the UAE

Real-time corporate FX & treasury management tools to protect your margins and automate conversions

Get Started in 4 Easy Steps

Create a Hubpay Business Account

Choose between Scale or Treasury plan

Complete a quick digital onboarding

Start receiving AUD payments via your named IBAN

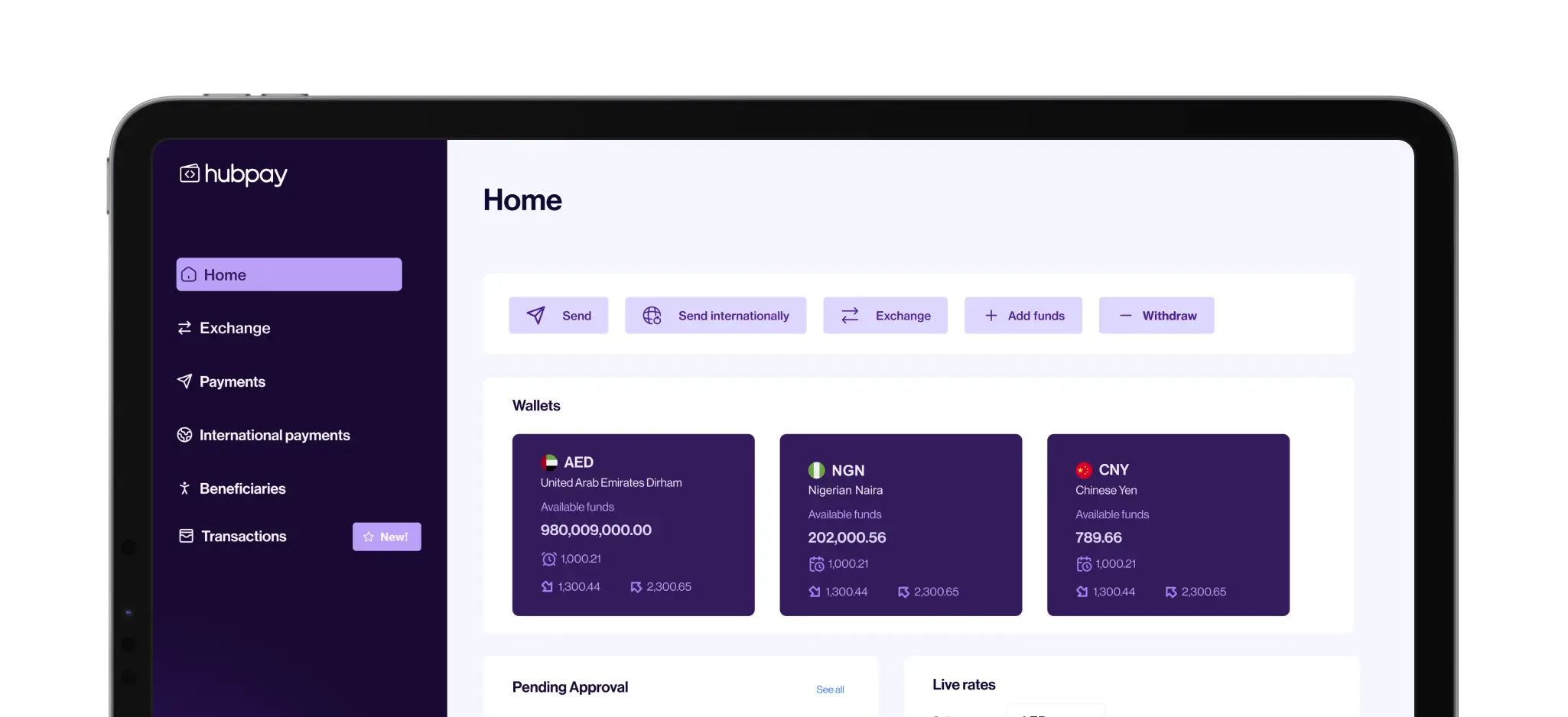

You’ll also be able to access powerful tools to manage, convert, and send funds all from a single platform.

Book a demo to see how it works

Frequently asked questions

Ready to open a AUD IBAN account in the UAE?

Start receiving payments in AUD, without the friction of traditional banks.

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.