FX Forwards: Secure Exchange Rates & Reduce Risk with Hubpay

Protect your business from currency volatility with Hubpay’s FX forwards. Lock in exchange rates, manage cash flow, and trade with confidence. Secure your transactions today!

Published on 14 March 2025

4 minutes read

FX Forwards: Secure Exchange Rates & Reduce Risk with Hubpay

FX forwards are a game-changer for businesses dealing with international transactions. Exchange rates rise and fall every day, making future costs unpredictable. But what if there was a way to lock in today’s rate and protect your money from sudden market swings?

Currency fluctuations can shrink profits and disrupt cash flow. A slight shift in the market can turn a good deal into a loss. Businesses that trade across borders need a way to keep costs stable. That’s where Hubpay’s FX forwards come in.

With a forward contract, you agree on an exchange rate today for a future transaction. No more guessing what the rate will be next month. No more stress over unexpected currency jumps. Hubpay helps businesses secure their exchange rate in advance, so they stay in control.

Whether you import supplies, pay foreign partners, or manage global payroll, FX forwards offer financial stability. They let you plan ahead, protect your bottom line, and avoid nasty surprises.

Hubpay makes foreign exchange hedging simple. With fast setups, low-cost deposits, and expert guidance, businesses can secure their future without the hassle. Take charge of your international payments today and trade with confidence.

What Are FX Forwards?

FX forwards are a simple way for businesses to protect themselves from unpredictable exchange rates. They allow you to lock in today’s exchange rate for a transaction that will happen in the future. This means you know exactly how much you will pay, no matter how the market moves.

Without FX forwards, businesses rely on Spot FX, which means exchanging currency at the current market rate. The problem? Exchange rates change every day. A deal that looks good today might cost much more in a few months.

With a forward contract, you agree on a fixed exchange rate today, but the payment happens later. Whether the rate goes up or down, your cost stays the same. This protects your business from sudden currency swings and helps you plan your finances better.

For Example

If you need to pay a supplier in three months, you can lock in today’s rate instead of taking a risk on future prices. Even if the market rate rises, you won’t have to pay more.

Hubpay makes securing FX forwards easy and affordable. With low deposit requirements and competitive rates, businesses can manage their international payments without stress. Hubpay also provides expert advice to help you choose the best strategy for your needs.

By using FX forwards, businesses avoid uncertainty, improve budgeting, and stay in control of their money. Instead of guessing what the market will do, you get stability and peace of mind.

How FX Forwards Help Businesses Manage Currency Risks

Protection Against Exchange Rate Volatility

Currency markets are unpredictable. Exchange rates can rise or fall in a matter of days. For businesses dealing with international payments, these sudden changes can increase costs and reduce profits.

Take a UAE business that imports goods from Europe. If the company needs to pay €500,000 in three months, the euro-dirham rate today may seem fair. But if the rate rises, the company will pay more than expected. This can hurt profit margins and create financial stress.

FX forwards solve this problem. By locking in today’s rate, businesses know exactly how much they will pay in the future. Even if the market moves against them, their costs remain stable. This reduces financial risk and allows them to focus on business growth.

Better Business Budgeting and Cash Flow Management

A business needs predictable costs to plan ahead. Currency fluctuations make it hard to estimate future expenses. Without FX forwards, companies must rely on market rates when making payments, which can lead to unexpected financial losses.

By using FX forwards, businesses can secure a fixed exchange rate for future transactions. This means no last-minute surprises and no need to adjust budgets due to currency swings. Companies can allocate resources with confidence and ensure smooth cash flow.

For example, a business paying international suppliers every quarter can set a fixed rate today. This protects their budget and prevents sudden cost increases. Hubpay’s FX forwards provide this stability, making financial planning easier and reducing uncertainty.

Avoiding Unexpected Costs in International Transactions

A strong currency today may weaken tomorrow. Without protection, businesses risk paying more than planned. This is especially true for companies making regular overseas payments.

Hubpay’s forward contracts shield businesses from currency depreciation. If a company secures an FX forward today, their future payments remain at the agreed rate. Even if market conditions change, their costs do not.

Consider a construction firm buying raw materials from another country. If the currency weakens before payment is due, the cost of materials increases. But with FX forwards, the company avoids this risk and stays within budget.

By choosing Hubpay’s FX forwards, businesses gain financial certainty, improve planning, and reduce risks. Instead of worrying about market changes, they can focus on growth and profitability.

Types of FX Forward Contracts Offered by Hubpay

Every business has different needs when it comes to currency management. FX forwards help companies secure a stable exchange rate, but not all forward contracts work the same way. Hubpay offers two types of forward contracts: Fixed Forward Contracts and Window Forward Contracts. Each has its own benefits, depending on how and when payments need to be made.

Fixed Forward Contracts

A Fixed Forward Contract is the best choice for businesses with strict payment deadlines. It allows companies to lock in an exchange rate for a specific future date. When that date arrives, they must complete the transaction at the agreed rate.

This type of contract is ideal for businesses that have fixed expenses. If a company knows exactly when they need to pay a supplier, a Fixed Forward Contract ensures they do not have to worry about market changes. Even if the exchange rate moves against them, their cost remains the same.

For example, if a UAE business has to pay €200,000 in six months, they can fix today’s euro-dirham rate. This guarantees that they will not pay extra if the euro strengthens before the payment is due.

Window Forward Contracts

A Window Forward Contract offers more flexibility. Instead of committing to one fixed date, businesses can draw down funds anytime within a set period.

This is perfect for companies that make payments in stages. If a business needs to pay multiple suppliers or has ongoing international transactions, a Window Forward Contract helps them manage cash flow smoothly.

For example, a fashion retailer importing goods from different suppliers across three months can use a Window Forward Contract. This allows them to access funds at the agreed exchange rate whenever they need them, instead of being locked into a single date.

Comparison: Fixed vs. Window Forward Contracts

Fixed Forward Contracts are more structured and ideal for businesses with scheduled payments.

Window Forward Contracts are more flexible and better for businesses with staggered or unpredictable expenses.

Hubpay makes both options easy to access with competitive rates and expert guidance. Whether businesses need structure or flexibility, FX forwards provide the financial stability they need to grow confidently.

Step-by-Step Guide: How to Secure an FX Forward Contract with Hubpay

Securing FX forwards with Hubpay is quick, simple, and cost-effective. Unlike traditional banks, which have complex processes and hidden fees, Hubpay makes currency hedging easy. Here’s how businesses can lock in their exchange rate in just a few steps.

Sign Up with Hubpay

The first step is to create an account. Hubpay’s online platform makes registration smooth and hassle-free. Businesses can sign up in minutes and gain access to expert FX solutions.

Choose Your Forward Contract

Hubpay offers two types of FX forwards: Fixed Forward Contracts and Window Forward Contracts. Businesses can choose the option that best fits their payment schedule. If payments are fixed, a Fixed Forward Contract is the best choice. If flexibility is needed, a Window Forward Contract is ideal.

Lock in Your Exchange Rate

Once the contract type is selected, businesses can lock in a competitive exchange rate. Hubpay provides real-time market rates, ensuring customers get the best deal available.

Pay a Small Deposit (5-10%)

To secure the contract, businesses need to pay a low deposit, usually between 5-10% of the contract value. This makes FX forwards affordable for businesses of all sizes.

Use the Contract When Needed

When the payment date arrives, businesses can settle their transaction at the pre-agreed rate. If they have a Window Forward Contract, they can draw down funds anytime within the agreed period.

Why Hubpay Is the Best FX Forward Provider for Businesses

Managing international payments can be stressful. Currency markets change daily, making costs unpredictable. That’s why businesses trust Hubpay to secure their exchange rates with FX forwards. Hubpay offers competitive rates, fast transactions, and expert support, making currency risk management simple and affordable.

Competitive Exchange Rates

Hubpay provides some of the best FX forward rates in the market. Businesses can lock in a strong rate today and avoid costly fluctuations. Unlike banks, which add extra fees, Hubpay ensures businesses get the most value for their money.

Fast & Secure Transactions

Speed matters in international trade. Hubpay processes FX forwards quickly, ensuring payments reach suppliers and partners on time. Businesses don’t have to worry about delays or missed deadlines. Hubpay’s secure platform keeps transactions safe, protecting businesses from fraud and currency risk.

Transparent Fees, No Hidden Charges

Many banks and brokers charge hidden fees for forward contracts. Hubpay keeps pricing clear and fair. Businesses know exactly what they are paying upfront, with no surprises later.

Flexibility for SMEs & Large Corporations

Hubpay’s FX forwards are designed for businesses of all sizes. Small businesses benefit from low deposit requirements, while large corporations enjoy customized hedging solutions. Whether a company needs a Fixed Forward Contract or a Window Forward Contract, Hubpay provides options that fit their needs.

Dedicated Account Managers for Expert Support

Currency markets can be complex. Hubpay offers dedicated account managers to help businesses make informed decisions. Clients receive personalized advice on when to secure their FX forward and how to manage their currency exposure.

Easy Online Management – No Complex Banking Procedures

Traditional banks require lengthy paperwork for FX forwards. Hubpay’s online platform makes managing forward contracts simple. Businesses can book contracts, track payments, and manage funds all in one place without dealing with complicated banking systems.

How Hubpay Helped a Business Save Money

A UAE-based import company struggled with fluctuating exchange rates. They had to pay suppliers in euros, but currency volatility increased their costs. After securing an FX forward with Hubpay, they locked in a stable exchange rate. This saved them thousands of dirhams and allowed them to plan their budget confidently.

With Hubpay’s FX forwards, businesses can trade internationally with peace of mind. They avoid market uncertainty, secure stable exchange rates, and focus on growth.

Common Misconceptions About FX Forward Contracts

Many businesses hesitate to use FX forwards because of common misunderstandings. However, forward contracts are simple, affordable, and beneficial for companies of all sizes.

Myth: FX forwards are only for large companies.

Many small and medium-sized businesses think forward contracts are only for big corporations. In reality, SMEs benefit the most from currency hedging. Even small exchange rate changes can affect profits. Hubpay’s FX forwards help businesses of all sizes protect their money and plan with confidence.

Myth: Forward contracts are expensive.

Some businesses assume that securing an FX forward requires a large upfront investment. However, Hubpay offers low-deposit options of just 5-10%. This makes it easy for companies to lock in a stable exchange rate without tying up too much capital.

Myth: It’s hard to predict the right time to secure a forward contract.

Many business owners worry about choosing the right moment to lock in a rate. Hubpay provides expert market insights and guidance to help businesses make informed decisions. With the right support, companies can avoid risks and secure a rate that works for them.

Conclusion

Unstable exchange rates can create financial uncertainty for businesses. A sudden currency shift can increase costs, disrupt cash flow, and affect profits. Hubpay’s FX forwards provide a solution by locking in exchange rates and eliminating surprises.

With FX forwards, businesses can manage currency risk, improve budgeting, and focus on growth. Whether making regular payments or one-time transactions, Hubpay offers flexible solutions to fit different needs.

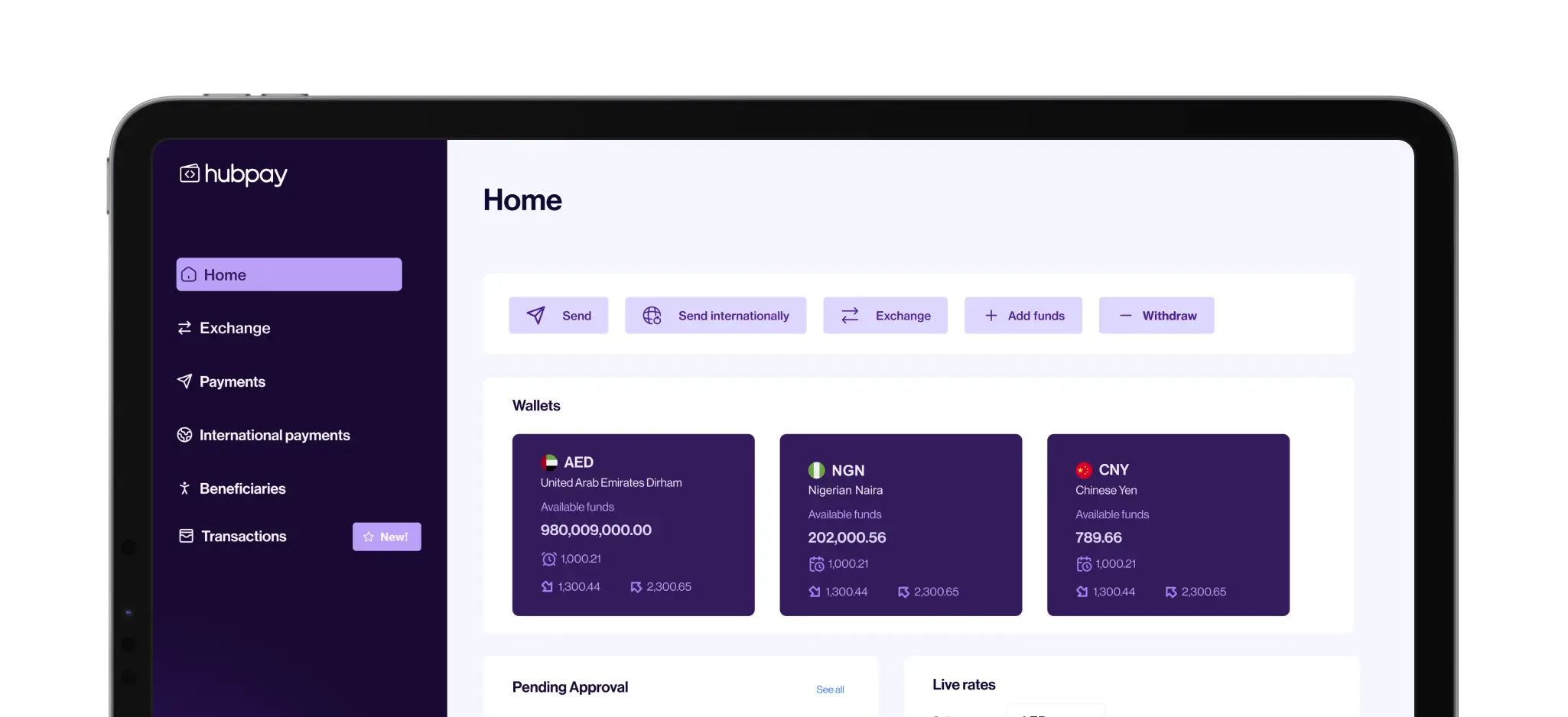

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.