Business setup in UAE: Your ultimate guide to launching successfully | Hubpay

Navigate the complexities of UAE business setup – from free zones to mainland, licenses, and top advisors. Discover how Hubpay simplifies corporate bank account opening for a seamless launch.

Published on 10 March 2025

Updated on

7 April 2025

3 min read

Launch your Business in the UAE: A comprehensive guide & seamless corporate account with Hubpay

The United Arab Emirates is a global hub for business, attracting entrepreneurs and investors with its dynamic economy, strategic location, and business-friendly policies. However, navigating the various options for business setup can feel overwhelming. This comprehensive guide will walk you through everything you need to know, from choosing the right business type to obtaining your license and, crucially, getting your corporate bank account opened effortlessly with Hubpay.

Understanding business structures in the UAE: Free Zone, Mainland, Offshore, Holding, and SPVs

1. Mainland Companies

A mainland company is registered with the Department of Economic Development (DED) in the respective emirate (e.g., Dubai DED).

Advantages:

Freedom to trade anywhere in the UAE and internationally.

Ability to undertake a wide range of business activities.

No restrictions on the number of visas.

Considerations:

Historically required a local UAE national sponsor with 51% ownership (though recent changes allow 100% foreign ownership in many sectors).

May be subject to more local regulations.

2. Free Zone Companies

Free zones are designated economic areas offering special incentives, often designed to promote specific industries.

Advantages:

100% foreign ownership.

0% corporate and income tax rates.

100% repatriation of capital and profits.

No customs duties on imports and exports within the free zone.

Simplified setup procedures and dedicated free zone authorities.

Considerations:

Business activities are typically limited to within the free zone or internationally. To operate on the mainland, you might need a local distributor or agent.

3. Offshore Companies

Offshore companies (or International Business Companies - IBCs) are typically used for asset protection, international trading, and holding purposes. They are not allowed to conduct business within the UAE itself.

Advantages:

100% foreign ownership.

0% tax.

High level of privacy.

No physical office space required in the UAE.

Considerations:

Cannot trade locally.

Limited activities (e.g., no financial services or real estate brokerage).

4. Holding Companies

A holding company's primary purpose is to hold assets, such as shares in other companies, real estate, or intellectual property. They can be set up in both mainland and free zones, though free zones are often preferred for the tax benefits and ease of ownership.

Advantages:

Asset protection and consolidation.

Tax efficiency (especially in free zones).

Simplified group structuring.

5. Special Purpose Vehicles (SPVs)

SPVs are legal entities created for a specific, limited purpose. They are often used in finance for securitization, isolated risk management, or to facilitate specific transactions. Certain free zones, like ADGM and DIFC, are ideal for setting up SPVs.

Advantages:

Legal separation of assets and liabilities.

Facilitates complex financial transactions.

Can be highly tailored to specific needs.

Choosing Your Business License Type

Your business activity will determine the type of license you need. The UAE offers a variety of licenses, including:

Commercial License: For trading activities (buying and selling goods).

Industrial License: For manufacturing and industrial activities.

Professional License: For service-oriented businesses (e.g., consulting, legal, accounting, marketing).

Tourism License: For travel and tourism-related businesses.

Agricultural License: For farming and related activities.

Craftsmanship License: For artisans and skilled workers.

It's crucial to select the correct license as it dictates what activities your company can legally undertake.

Top Free Zones Across the 7 Emirates

The UAE boasts over 60 free zones, each with unique advantages and industry specializations. Here are some of the most prominent ones across the seven emirates:

Dubai:

Dubai Multi Commodities Centre (DMCC): Ideal for commodities trading, financial services, and a wide range of other businesses. DMCC Website

Jebel Ali Free Zone (JAFZA): A leading global hub for logistics, trade, and manufacturing. JAFZA Website

Dubai Internet City (DIC): Focuses on technology, e-commerce, and digital businesses. DIC Website

Dubai Media City (DMC): A hub for media, advertising, and creative industries. DMC Website

Dubai Healthcare City (DHCC): Dedicated to healthcare, medical education, and pharmaceuticals. DHCC Website

Dubai International Financial Centre (DIFC): A leading financial hub for the Middle East, Africa, and South Asia (MEASA) region. DIFC Website

Abu Dhabi:

Abu Dhabi Global Market (ADGM): An international financial free zone offering a robust regulatory framework. ADGM Website

Khalifa Industrial Zone Abu Dhabi (KIZAD): A major industrial and logistics hub. KIZAD Website

Twofour54: Specializes in media and entertainment industries. Twofour54 Website

Sharjah:

Sharjah Airport International Free Zone (SAIF Zone): Offers excellent connectivity for logistics and industrial businesses. SAIF Zone Website

Sharjah Publishing City Free Zone (SPCFZ): Caters to the publishing, printing, and media industries. SPCFZ Website

Ajman:

Ajman Free Zone (AFZ): One of the oldest and most cost-effective free zones, suitable for various business activities. AFZ Website

Ras Al Khaimah:

Ras Al Khaimah Economic Zone (RAKEZ): A comprehensive free zone offering tailored solutions for diverse industries. RAKEZ Website

Fujairah:

Fujairah Creative City Free Zone (FCC): Focuses on media, consulting, and e-commerce. FCC Website

Umm Al Quwain:

Umm Al Quwain Free Trade Zone (UAQ FTZ): Offers affordable setup costs and a simplified process. UAQ FTZ Website

Partnering with Business Setup Companies: Your Key to a Smooth Launch

While it's possible to navigate the business setup process yourself, it can be complex, time-consuming, and prone to errors due to the multitude of options and ever-evolving regulations. Engaging a reputable business setup company can save you significant time, money, and headaches. They offer expert guidance, handle paperwork, and liaise with government authorities.

Here are some of the top business setup companies in the UAE:

Virtuzone: A leading provider with extensive experience, offering end-to-end corporate services including setup, visas, and compliance. Virtuzone Website

SME Corp: Provides comprehensive business setup solutions and advisory services. SME Corp Website

Sovereign Corporate Services: Offers a wide range of corporate services, including company formation and fiduciary services. Sovereign Corporate Services Website

Kilani & Co.: Specializes in corporate and commercial legal services, including company formation. Kilani & Co. Website

Inzone: InZone Business Setup is one of the leading business setup service provider. Inzone website

Creative Zone: A team of professionals who are passionate about bringing the dreams of aspiring entrepreneurs and SME’s to life. Creative zone webiste

These companies can assist with:

Choosing the right legal structure and license.

Trade name reservation and initial approvals.

Drafting and notarizing Memorandum of Association (MOA).

Office space solutions (flexi-desks to dedicated offices).

Visa processing for owners and employees.

Ongoing compliance and PRO services.

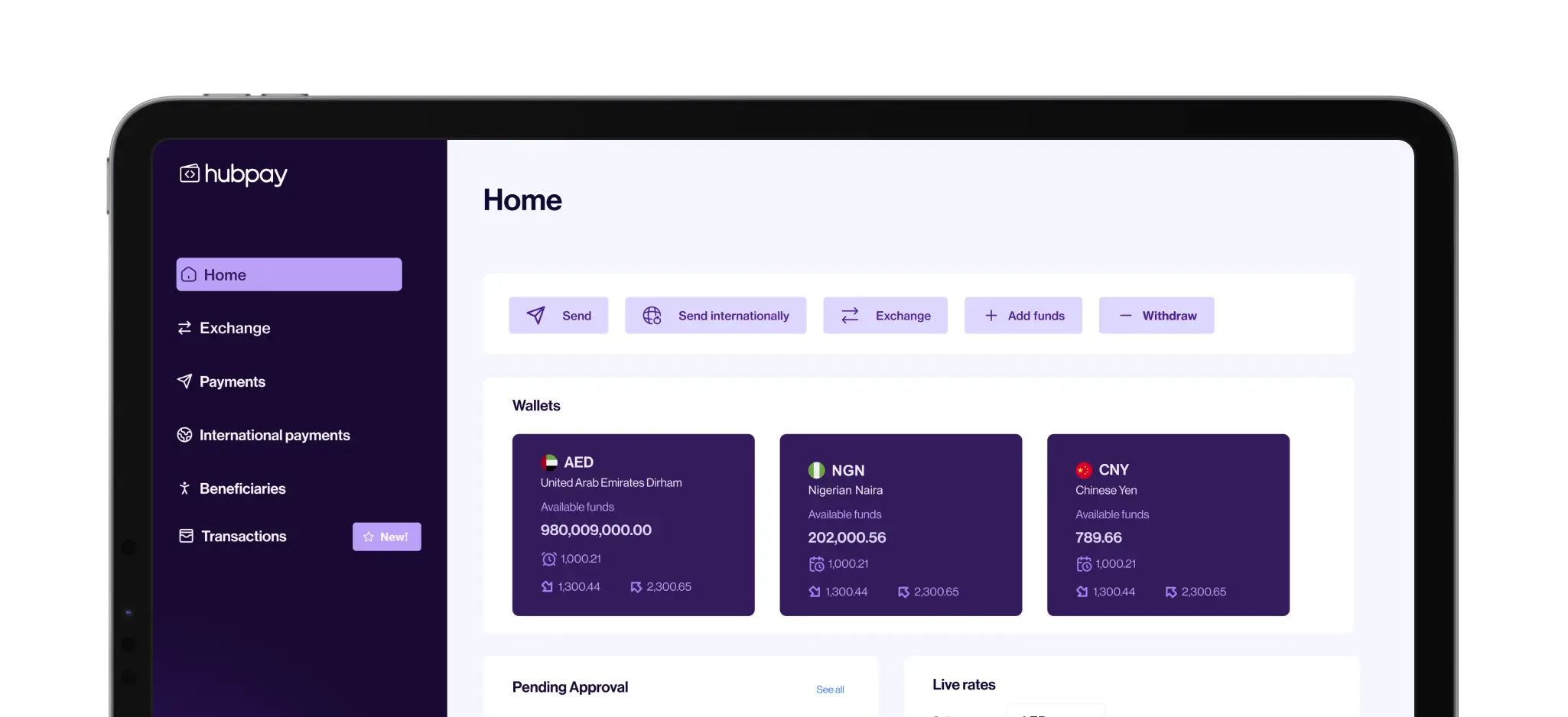

The Final (and Easiest) Step: Opening Your Corporate Account with Hubpay

Once your business is set up and your license is secured, the next crucial step is opening a corporate bank account. This can often be the most tedious and time-consuming part of the process with traditional providers, involving extensive documentation and long approval wait times.

This is where Hubpay comes in.

Hubpay offers a significantly faster and more transparent alternative for new businesses in the UAE. Our fully digital onboarding process means you can go live financially from day one, without the hassle of endless paperwork and lengthy delays.

Why choose Hubpay for your corporate account?

Zero minimum balance requirements

Multi-currency virtual IBANs (EUR, GBP, AUD, and more)

Payment links to collect global funds instantly

International mass payments for payroll, vendors, and contractors

Rapid fully digital onboarding within 1 business day

Learn more about Hubpay's Business Accounts

Frequently asked questions

Apply for a free corporate account with Hubpay!

Go financially live from day 1 with Hubpay Business Account. Transparent pricing, seamless digital onboarding and zero minimum balance requirement.

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.