Discover how a digital wallet can transform payments with secure, convenient, and eco-friendly solutions. Learn their benefits, types, and future trends.

Published on 18 February 2025

4 minutes read

In the fast-evolving world of technology, digital wallets have emerged as a game-changing innovation, revolutionizing the way we manage money, make payments, and handle transactions. A digital wallet, sometimes referred to as an e-wallet, is a secure, electronic platform that stores payment information, enabling users to complete transactions without the need for physical cash or cards. As the global shift towards cashless economies continues, digital wallets are playing a pivotal role in transforming personal finance and commerce.

What is a Digital Wallet?

A digital wallet is an application or platform that securely stores a user’s payment credentials, such as credit and debit card information, bank account details, and even cryptocurrency keys. It can also hold other essentials like loyalty cards, tickets, and identification documents. Users can access their digital wallet via smartphones, tablets, or computers to make purchases online, in physical stores, or send money to friends and family.

By replacing the need for traditional wallets and physical payment methods, digital wallets offer unparalleled convenience and security. Leading digital wallet providers include Apple Pay, Google Pay, Samsung Pay, and PayPal, but regional solutions and fintech startups are continually expanding the landscape.

Why Are Digital Wallets Becoming So Popular?

Convenience at Your Fingertips

Digital wallets eliminate the need to carry cash, credit cards, or checks. With a smartphone, users can make purchases, split bills, or transfer funds in seconds. This convenience is especially valuable in a fast-paced world where time is of the essence.Enhanced Security

Advanced encryption, biometric authentication (like fingerprint or facial recognition), and tokenization make digital wallets significantly more secure than traditional wallets. These features protect users against fraud, theft, and data breaches.Global Acceptance

The widespread adoption of point-of-sale (POS) systems and online payment gateways ensures that digital wallets are accepted almost everywhere, making international travel and e-commerce easier than ever.Eco-Friendly Transactions

By reducing the reliance on paper-based receipts, cash, and plastic cards, digital wallets contribute to a more sustainable, eco-conscious economy.Integration with Other Financial Tools

Many digital wallets offer integration with budgeting tools, rewards programs, and investment platforms, empowering users to manage their finances more effectively.

Types of Digital Wallets

Not all digital wallets are created equal. They can be broadly categorized into three types based on their functionality and purpose:

Closed Wallets

These are specific to a single company or platform, allowing users to make transactions only with that provider. For instance, e-commerce giants like Amazon and Starbucks use closed wallets to enhance customer loyalty and streamline payments.

Semi-Closed Wallets

Semi-closed wallets, such as Paytm or Venmo, are more flexible, allowing users to transact with multiple merchants that have partnered with the wallet provider.

Open Wallets

Open wallets are the most versatile. They are issued by banks or financial institutions and allow users to make payments, withdraw cash, and transfer funds to any account. Apple Pay and Google Pay are examples of open wallets.

How Digital Wallets Work

Digital wallets function by securely storing users’ payment information and utilizing it to process transactions. Here’s how a typical digital wallet transaction works:

Account Setup: Users download the digital wallet app and create an account by linking their bank accounts, credit cards, or debit cards.

Authentication: Users set up security features like passwords, PINs, or biometrics to ensure only authorized access to the wallet.

Making a Payment: At checkout, users can select their digital wallet, authenticate the transaction, and tap their phone on a POS terminal or click a button online.

Transaction Processing: The wallet communicates with the payment gateway, ensuring the funds are transferred securely to the merchant or recipient.

Key Benefits of Digital Wallets

Digital wallets offer a plethora of advantages to consumers, businesses, and even governments striving to digitize economies. Here are some of the most notable benefits:

For Consumers:

Seamless Transactions: Say goodbye to fumbling for change or cards.

Enhanced Financial Management: Track spending habits with in-app insights and analytics.

Loyalty Rewards: Many wallets integrate with reward programs, offering discounts and cashback.

For Businesses:

Reduced Payment Processing Time: Digital payments are faster, reducing checkout times and improving the customer experience.

Lower Costs: Businesses can save on handling cash and benefit from competitive transaction fees.

Broader Customer Reach: Accepting digital payments attracts tech-savvy customers and enables cross-border commerce.

For Economies:

Reduced Informal Economies: Digital wallets promote transparency and reduce tax evasion.

Increased Financial Inclusion: By bridging the gap for the unbanked population, digital wallets make financial services accessible to all.

Challenges and Concerns

Despite their numerous advantages, digital wallets are not without challenges. Understanding these issues can help providers improve their services and build trust with users.

Security Risks

While digital wallets are generally secure, they are not immune to cyberattacks. Phishing scams, malware, and data breaches remain potential threats.

Limited Adoption in Certain Regions

In some countries, digital wallets face hurdles due to inadequate internet infrastructure, lack of awareness, or resistance to change.

Interoperability Issues

Not all wallets are universally accepted, which can frustrate users who need to juggle multiple platforms.

Dependence on Technology

Digital wallets rely on smartphones, internet connectivity, and software updates, which can be problematic in remote or underserved areas.

The Future of Digital Wallets

The future of digital wallets looks bright, driven by advancements in technology and changing consumer preferences Accordingly. Key trends to watch include:

Integration with Cryptocurrencies: As blockchain technology gains traction, digital wallets will likely incorporate crypto storage and transactions seamlessly.

AI and Personalization: Artificial intelligence will enable wallets to offer tailored recommendations, budgeting advice, and fraud detection.

Wearable Payments: Smartwatches and other wearables equipped with payment capabilities will make digital wallets even more accessible.

Contactless Payments: The rise of NFC and QR code-based payments will continue to boost adoption rates.

Super Apps: Digital wallets may evolve into "super apps," consolidating payments, banking, shopping, and other services into a single platform.

Tips for Choosing the Right Digital Wallet

Selecting the right digital wallet depends on your lifestyle and financial needs. Here are some factors to consider:

Compatibility: Ensure the wallet works with your devices and preferred merchants.

Security Features: Look for wallets with robust encryption, tokenization, and biometric authentication.

Fees: Some wallets charge transaction fees or currency conversion rates, so compare costs before committing.

User Experience: A clean interface and responsive customer support can enhance your overall experience.

As the world moves towards a digital-first future, digital wallets are no longer a luxury but a necessity. They offer a secure, efficient, and sustainable way to manage finances, catering to both individual and business needs. Whether you're looking to simplify daily transactions, enhance financial control, or embrace the latest fintech innovations, digital wallets are your gateway to the future of payments.

With their growing ubiquity and potential to integrate with emerging technologies, digital wallets will continue to shape the way we live, work, and transact. Start exploring the digital wallet that fits your needs today and join the global shift towards a cashless society.

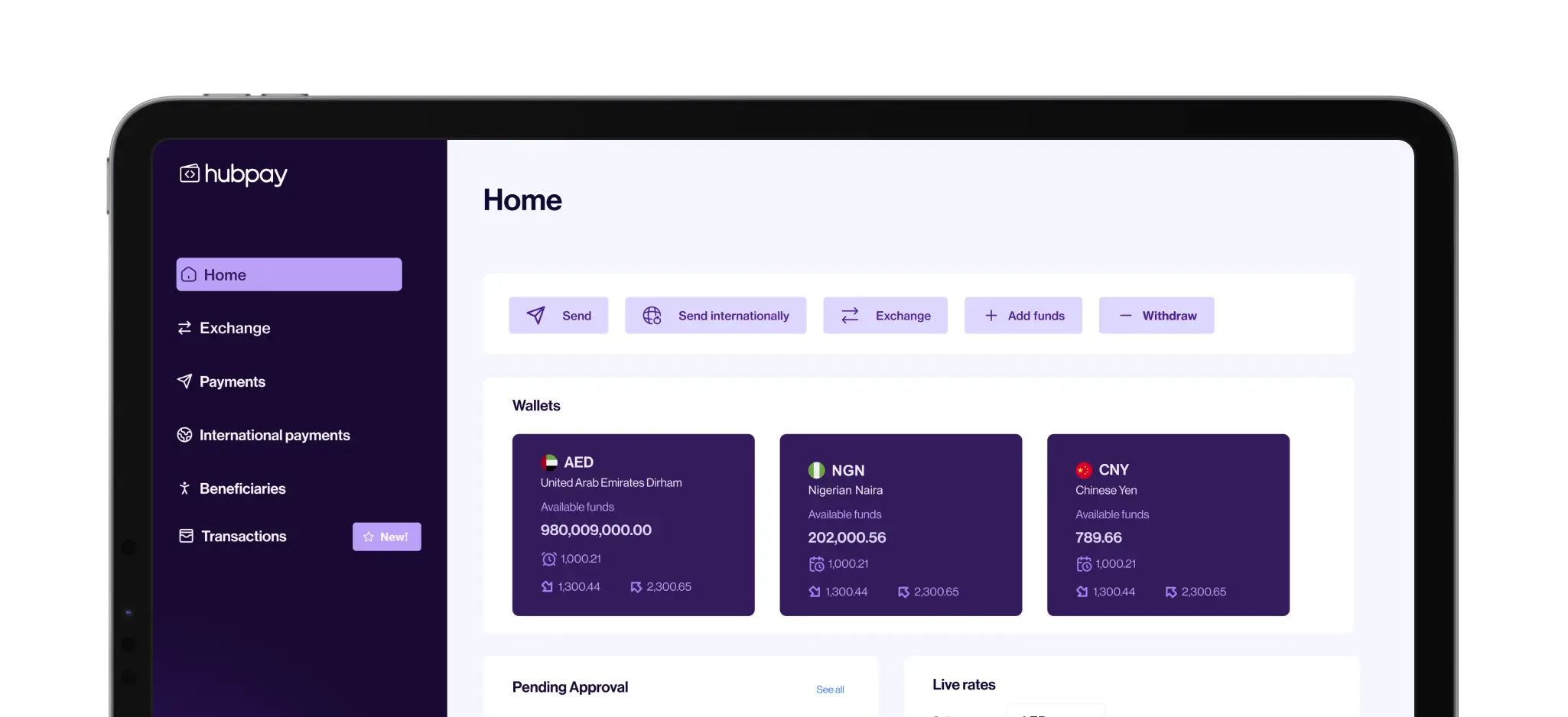

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.