Discover how digital wallets simplify multi-currency management with real-time exchange, low fees, and global accessibility for individuals and businesses.

Published on 30 January 2025

5 minutes read

In today’s interconnected world, where international travel, remote work, and cross-border transactions are more common than ever, managing multiple currencies efficiently has become a necessity. Digital wallets have emerged as a vital solution, making multi-currency transactions seamless, secure, and highly accessible. By combining cutting-edge technology with intuitive design, digital wallets empower users to hold, transfer, and spend money across currencies, eliminating traditional barriers to global financial management.

What Makes Digital Wallets Ideal for Multi-Currency Management?

1. Real-Time Currency Exchange

Gone are the days of standing in line at exchange counters or paying exorbitant fees at banks. Digital wallets allow users to convert currencies in real-time, often at competitive rates. This makes them perfect for frequent travelers, expatriates, and anyone involved in international business.

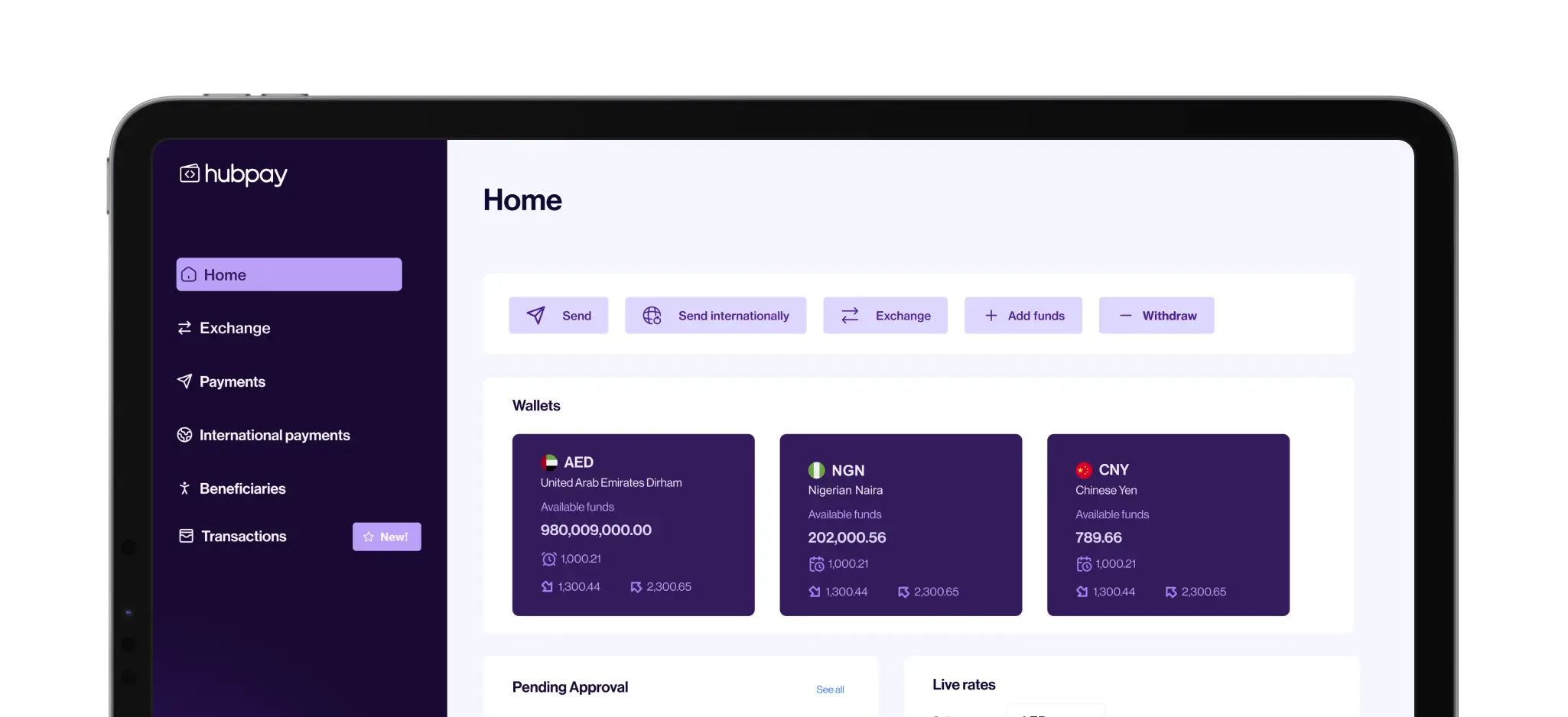

2. Unified Management

Instead of juggling multiple bank accounts or physical wallets, digital wallets consolidate your funds in one place. You can store, manage, and monitor balances across various currencies through a single platform, saving both time and effort.

3. Ease of Cross-Border Payments

Whether you’re paying for goods and services abroad or sending money to family in another country, digital wallets simplify cross-border payments. They bypass traditional banking systems, enabling faster and often cheaper transactions.

4. Fee Transparency

Digital wallets provide clear insights into fees for currency conversions and international transfers. This transparency helps users make informed decisions and avoid hidden charges.

The Role of Digital Wallets in a Globalized Economy

Globalization has blurred borders in commerce, education, and work. Digital wallets are perfectly suited to this environment, addressing the growing demand for multi-currency accounts and cross-border payment solutions. Their adaptability makes them indispensable for various use cases:

For Travelers

A digital wallet eliminates the need to carry multiple foreign currencies. Travelers can make purchases or withdraw local currency directly from their wallet while abroad, reducing the hassle and security risks of carrying cash.

For Freelancers and Remote Workers

Freelancers working with international clients often receive payments in different currencies. Digital wallets allow them to hold multiple currencies in their account and convert them as needed, minimizing losses from unfavorable exchange rates.

For E-Commerce Enthusiasts

Shoppers who purchase goods from global retailers often face issues with currency compatibility. Digital wallets make it easy to pay in the seller’s currency without worrying about extra charges or delays.

For Businesses

Small businesses and startups that deal with international suppliers or customers benefit from digital wallets’ multi-currency capabilities. They can accept payments in different currencies and manage funds without relying on complex and costly banking structures.

Key Features of Multi-Currency Digital Wallets

When choosing a digital wallet for multi-currency use, it’s important to understand the features that set them apart. Here are some must-have capabilities:

1. Multi-Currency Balances

The ability to hold and manage balances in multiple currencies is the core feature of a digital wallet. Look for wallets that support a wide range of currencies and offer flexibility in switching between them.

2. Exchange Rate Locking

Some digital wallets allow users to lock in exchange rates for a specified period. This feature can be invaluable for businesses or travelers who want to avoid fluctuations in the forex market.

3. Global Accessibility

A good multi-currency digital wallet works seamlessly across borders. Whether you’re accessing it from your smartphone in Asia or your laptop in Europe, the wallet should be accessible and functional.

4. Low Conversion and Transfer Fees

Competitive fees are essential for a cost-effective experience. Look for wallets that offer low conversion rates and reduced fees for cross-border transactions.

5. Security Features

Multi-currency wallets handle high-value transactions, making robust security features like encryption, two-factor authentication, and fraud detection crucial.

The Advantages of Multi-Currency Digital Wallets

Digital wallets designed for multi-currency management come with unique advantages that cater to the diverse needs of global citizens.

For Individuals

Simplified Spending Abroad: You can shop or dine in another country without worrying about currency exchange.

Reduced Costs: Competitive conversion rates and lower transfer fees mean you save money compared to traditional methods.

24/7 Access: Digital wallets give you complete control over your funds anytime, anywhere.

For Businesses

Streamlined Operations: Multi-currency wallets simplify invoicing and payment collection in international trade.

Improved Cash Flow: Faster processing times ensure that funds are available when needed.

Customer Convenience: Businesses that accept payments in multiple currencies attract a wider customer base.

Real-Life Scenarios Where Multi-Currency Digital Wallets Shine

Scenario 1: The Frequent Traveler

Imagine Sarah, a consultant who frequently travels between Europe, the US, and Asia. With a multi-currency digital wallet, Sarah doesn’t need to visit currency exchange counters. She uses her wallet to pay for hotel bookings in euros, shop in dollars, and dine in yen—all while tracking her expenses on a single platform.

Scenario 2: The Remote Worker

John, a freelance graphic designer, works with clients from around the world. He receives payments in euros, pounds, and dollars. With his multi-currency digital wallet, John can hold funds in different currencies, pay local taxes, and withdraw the money to his local bank account whenever needed.

Scenario 3: The Small Business Owner

Lisa runs an online boutique that sells products globally. Her multi-currency digital wallet allows her to accept payments in her customers’ currencies, saving on conversion fees and improving customer satisfaction.

How Digital Wallets Are Reshaping Financial Freedom

The ability to manage multiple currencies efficiently is no longer a luxury—it’s a necessity in today’s globalized world. Digital wallets offer more than just convenience; they empower users with financial freedom by providing access to tools that were once exclusive to banks and large institutions.

The Link Between Digital Wallets and Financial Inclusion

Digital wallets also play a critical role in financial inclusion by providing access to financial services for underbanked populations. In regions where traditional banking infrastructure is limited, multi-currency digital wallets enable individuals to participate in global commerce and connect with the wider economy.

Choosing the Right Digital Wallet for Multi-Currency Needs

Not all digital wallets are created equal, and selecting the right one depends on your specific needs. Here are some tips:

Assess Currency Support: Ensure the wallet supports the currencies you deal with most frequently.

Review Fees: Look for transparent pricing with low conversion and transaction fees.

Check Security Measures: Prioritize wallets with advanced security features.

Consider User Experience: A simple, intuitive interface makes managing finances easier.

As globalization continues to reshape the way we live and work, digital wallets are becoming indispensable tools for managing multiple currencies. They simplify international transactions, reduce costs, and give users more control over their finances, whether they’re travelers, freelancers, or businesses. By adopting a digital wallet that supports multi-currency management, you can unlock a world of possibilities and stay ahead in an increasingly borderless economy.

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Frequently asked questions

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.