Electronic Money Institution in UAE: How to Open One Online in 2025

Looking to open an account with an Electronic Money Institution in the UAE? This guide explains how UAE businesses and expats can access multi-currency e-money accounts without stress.

Published on 25 March 2025

5 minutes read

Electronic Money Institution in UAE: How to Open One Online in 2025

An Electronic Money Institution (EMI) in UAE provides a seamless way for individuals and businesses to send, receive, and manage money across borders. Unlike traditional banks, EMIs offer digital banking solutions that are fast, secure, and cost-effective. Expats and companies rely on these multi-currency e-money accounts to streamline international transactions.

However, opening a business account in the UAE through a traditional bank can be challenging. High minimum balance requirements, lengthy approval processes, and hidden fees make it difficult for businesses and freelancers to access global payment solutions. Many users face issues with paperwork, compliance regulations, and slow fund transfers.

Fintech Platforms: Role in EM

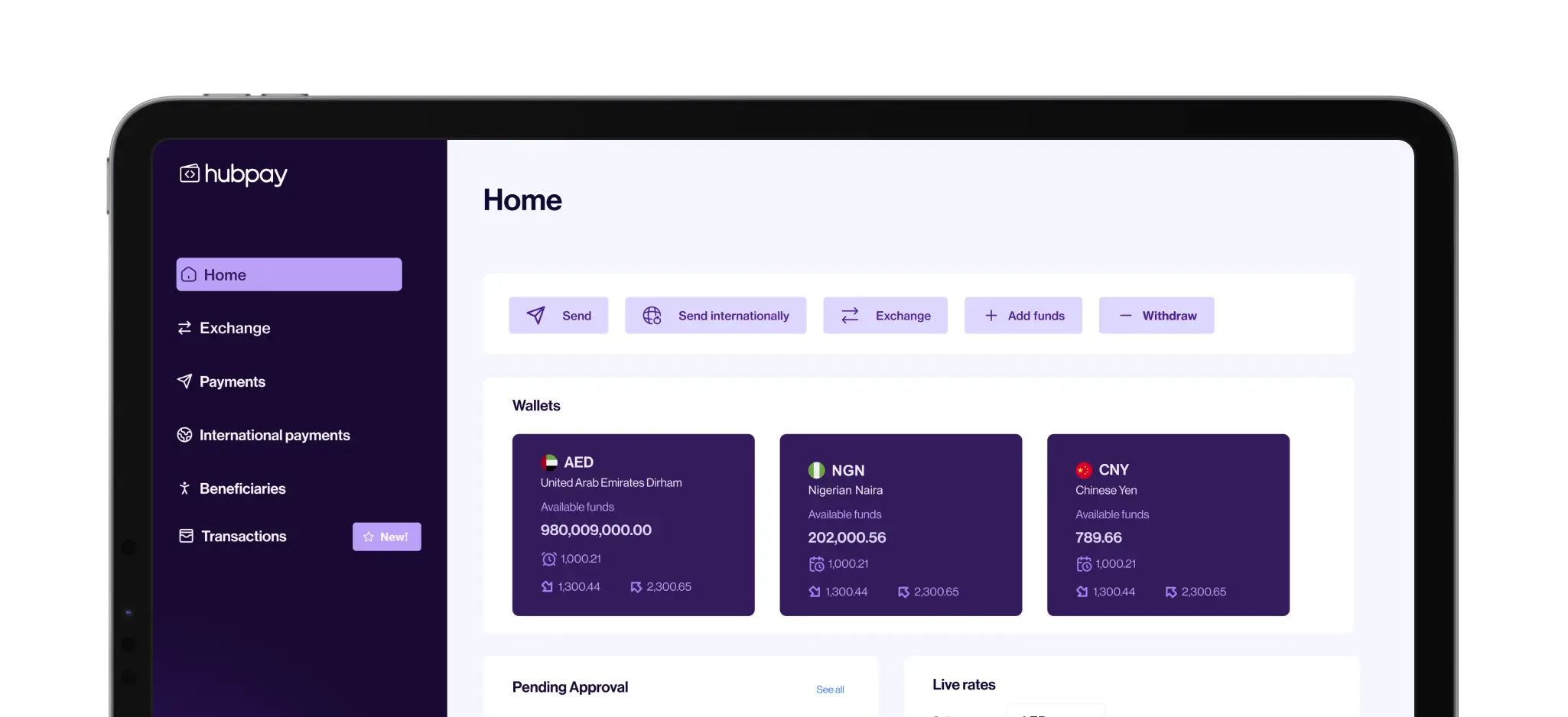

Fortunately, fintech platforms like Hubpay simplify the process. With an Electronic Money Institution account in UAE, businesses and individuals can hold, exchange, and transfer multiple currencies instantly. A multi-currency EMI account enables seamless supplier payments, payroll processing, and international remittances, ensuring lower fees, better exchange rates, and quicker transactions.

In this guide, we will explain everything you need to know about opening an EMI account online in the UAE. You'll also discover how to set up a digital wallet, manage multi-currency funds, and benefit from the flexibility of fintech-powered banking solutions

Benefits of an Electronic Money Institution Account in UAE

Multi-Currency Wallet

A multi-currency EMI account allows you to hold and manage different currencies in one place. This eliminates unnecessary currency conversion fees when making international payments.

Instant Cross-Border Transactions

With an EMI business account, sending and receiving money internationally is quick and seamless. You no longer have to deal with delays, hidden fees, or complex paperwork.

Global Financial Flexibility

Businesses can pay international suppliers, employees, and contractors without currency restrictions. Expats and freelancers can send and receive payments across borders with ease.

Competitive Exchange Rates

Unlike traditional banks, fintech platforms provide lower foreign exchange rates, helping businesses and individuals save on currency conversion costs.

Digital-First Banking Experience

With e-money accounts in UAE, you can manage transactions, track expenses, and make global payments online, all from a single dashboard.

A multi-currency EMI account in UAE helps businesses expand globally by simplifying cross-border transactions. Whether you’re a startup, freelancer, or expat, electronic money institutions provide the best alternative to traditional banks for managing international financial operations.

Challenges of Opening an EMI Account in UAE

Many businesses and expats in the UAE look for ways to open a multi-currency account for global transactions. While traditional banks offer international banking services, the process is often slow, costly, and complex. Electronic Money Institutions (EMIs) in UAE provide a more efficient alternative, but it’s essential to understand the challenges that come with traditional banking.

High Minimum Balance Requirements

Most UAE banks require a high minimum balance to keep an account active. Some demand $10,000 or more, making it difficult for small businesses, freelancers, and startups to afford.

Lengthy Documentation & Approval Delays

Opening a business account in the UAE with a traditional bank involves complex paperwork. You must submit:

Proof of identity (passport, Emirates ID, residency visa)

Trade license and company registration documents

Financial statements and proof of income

Even after submitting all documents, the approval process can take weeks or even months, delaying access to global banking services.

Hidden Fees & Unfavorable Exchange Rates

Traditional banks often charge hidden fees for:

Account maintenance

International wire transfers

Currency conversion

Additionally, most banks offer poor exchange rates, increasing the cost of cross-border transactions for businesses and expats.

Regulatory Barriers & Global Banking Restrictions

Banks follow strict compliance regulations in the UAE, often leading to:

Frozen accounts due to verification checks

Delayed transactions for compliance reviews

Limited access to funds for overseas transactions

This creates challenges for companies managing international payments or individuals sending remittances to their home countries.

A Smarter Alternative: Electronic Money Institution in UAE

Instead of dealing with banking restrictions, high costs, and approval delays, you can open an EMI account in UAE with a fintech provider like Hubpay.

Faster account approval with minimal paperwork

Lower transaction fees and better exchange rates

Seamless international payments without banking delays

Multi-currency digital wallet for global transactions

With a multi-currency EMI account in UAE, businesses, freelancers, and expats can send, receive, and manage money effortlessly, without the limitations of traditional banking.

Opening an Electronic Money Institution (EMI) Account in UAE

Opening an Electronic Money Institution (EMI) account in UAE is now easier than ever. Unlike traditional banks that require in-person visits and lengthy approval times, fintech platforms provide a fast, digital-first solution. You can now open an EMI account online in just a few steps.

Step 1: Choose the Right Fintech Provider

Before opening an EMI account in UAE, it’s important to select a reliable provider. Traditional banks often have high fees, slow approvals, and strict regulations. Instead, fintech solutions like Hubpay offer:

Quick online account setup

Low transaction fees

Multi-currency support

Better exchange rates

Step 2: Check Eligibility & Required Documents

Each Electronic Money Institution (EMI) has its own requirements. To open an EMI account in UAE, you may need:

A valid passport or Emirates ID

A UAE residence visa (for individuals and freelancers)

A business license (for companies and startups)

Proof of income or recent bank statements

Unlike traditional banks, fintech platforms require minimal documentation, making the process fast and hassle-free.

Step 3: Apply Online (Account Verification & Activation)

Once your documents are ready, follow these simple steps:

Fill in your personal or business details on the fintech platform.

Upload the required documents for verification.

Wait for account verification, which typically takes 24 to 48 hours.

After successful verification, your EMI account in UAE will be activated.

Step 4: Fund & Manage Your Multi-Currency EMI Account

Now that your account is active, you can deposit funds and start managing your digital wallet. With a multi-currency EMI account in UAE, you can:

Hold and manage multiple currencies in one account.

Convert funds at competitive exchange rates.

Send and receive international payments instantly.

By choosing a fintech-powered EMI account, businesses and individuals can access global financial services without dealing with traditional banking hurdles. It’s the fastest, most secure, and cost-effective solution for international transactions.

Best Multi-Currency EMI Business Solutions

Businesses in the UAE need a multi-currency EMI account to efficiently manage global payments. While traditional banks offer this service, they often come with high fees, slow processing times, and complex regulations. Fintech solutions like Hubpay provide a faster, more affordable, and flexible alternative.

Hubpay vs. Traditional Banks

Lower Transaction Costs & Real-Time FX Rates

Banks: Charge high foreign exchange fees and markups on international payments.

Hubpay: Offers real-time FX rates with low transaction costs, helping businesses save money on global transfers.

Fast & Secure Multi-Currency Wallet Setup

Banks: Take weeks to open a multi-currency business account in UAE due to paperwork and compliance checks.

Hubpay: Enables 24-hour EMI account activation, allowing businesses to send and receive money instantly.

No Hidden Charges & Instant Virtual IBAN

Banks: Have hidden fees for account maintenance, international transfers, and currency conversion.

Hubpay: Provides transparent pricing with no extra costs and instant access to a virtual IBAN account UAE.

Best Fintech Alternative for International Transactions

Banks: Often delay cross-border payments due to compliance reviews, causing cash flow issues for businesses.

Hubpay: Ensures fast, secure, and cost-effective international transfers with trusted global banking partners.

Reason to Choose an EMI Business Account

A multi-currency EMI account UAE allows businesses to:

Hold, exchange, and manage multiple currencies in one digital wallet.

Send and receive international payments instantly, avoiding banking delays.

Access competitive exchange rates for cost-effective cross-border transactions.

Expand globally with fintech-powered banking solutions, eliminating traditional banking limitations.

With a virtual IBAN account UAE, businesses gain seamless financial access to international markets, all without the restrictions of traditional banks. Fintech solutions like Hubpay provide a faster, more secure, and affordable alternative for global business transactions.

Simplifying Global Payments for UAE Businesses

Multi-Currency Wallets

With Hubpay's EMI business account UAE, companies can store, send, and receive over 150 currencies in one multi-currency digital wallet. This eliminates the need for multiple bank accounts, reduces currency exchange fees, and simplifies international payments.

Virtual IBANs for Global Payments

A virtual IBAN account UAE allows businesses to send and receive payments worldwide effortlessly. By sharing their unique IBAN details, companies can receive funds from international clients without the delays and extra banking fees imposed by traditional banks.

Faster FX Transactions

Real-time foreign exchange rates ensure businesses get the best currency conversion deals.

T+1 settlement speeds mean payments are processed within one business day, significantly faster than traditional banks.

Lower FX margins help businesses save money on international transfers.

EMI Account Over Traditional Banks

Traditional banks come with slow approvals, high international transaction fees, and hidden charges, making it difficult for businesses to manage global transactions efficiently. In contrast, Hubpay offers instant EMI account activation, fast FX settlements, and transparent pricing, ensuring a seamless banking experience. Banks also require extensive paperwork and long waiting periods for verification, delaying access to essential financial services.

With Hubpay, businesses benefit from minimal documentation, quick onboarding, and 24/7 access to global payments, making international transactions faster, easier, and more cost-effective.

For UAE businesses, having a multi-currency EMI account is essential for seamless global transactions. Hubpay’s EMI banking solution offers a secure, cost-effective, and hassle-free alternative to traditional banking, ensuring businesses can manage international payments efficiently.

Final Thoughts

A multi-currency EMI account is essential for businesses, freelancers, and expats in the UAE who need to send, receive, and hold money in multiple currencies. However, traditional banks make this process challenging with high fees, slow approvals, and complex paperwork. Fintech solutions like Hubpay offer a faster, more flexible, and cost-effective alternative to traditional banking.

With Hubpay’s EMI account in UAE, users gain access to a secure multi-currency wallet for global transactions, real-time FX rates with low-cost currency exchange, and virtual IBANs for seamless international payments. Additionally, Hubpay ensures fast account activation with minimal paperwork, making it easier than ever to manage cross-border transactions, make bulk payments, and hold multiple currencies.

Whether you're a business owner, freelancer, or expat, Hubpay’s fintech-powered EMI banking provides quick, secure, and transparent global payment solutions, without hidden fees or banking delays.

Sign up with Hubpay today and take control of your international payments effortlessly!

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.