Top 5 Features of Hubpay Business Accounts in 2025

Say goodbye to high fees and slow transactions. Hubpay Business Accounts offer transparent pricing, multi-currency Virtual IBANs, risk management tools, and fully digital onboarding for seamless global payments.

Published on 17 March 2025

4 minutes read

Managing business finances should be simple, but traditional financial providers make it complicated. Hidden fees, slow transactions, and endless paperwork create unnecessary obstacles for businesses trying to grow.

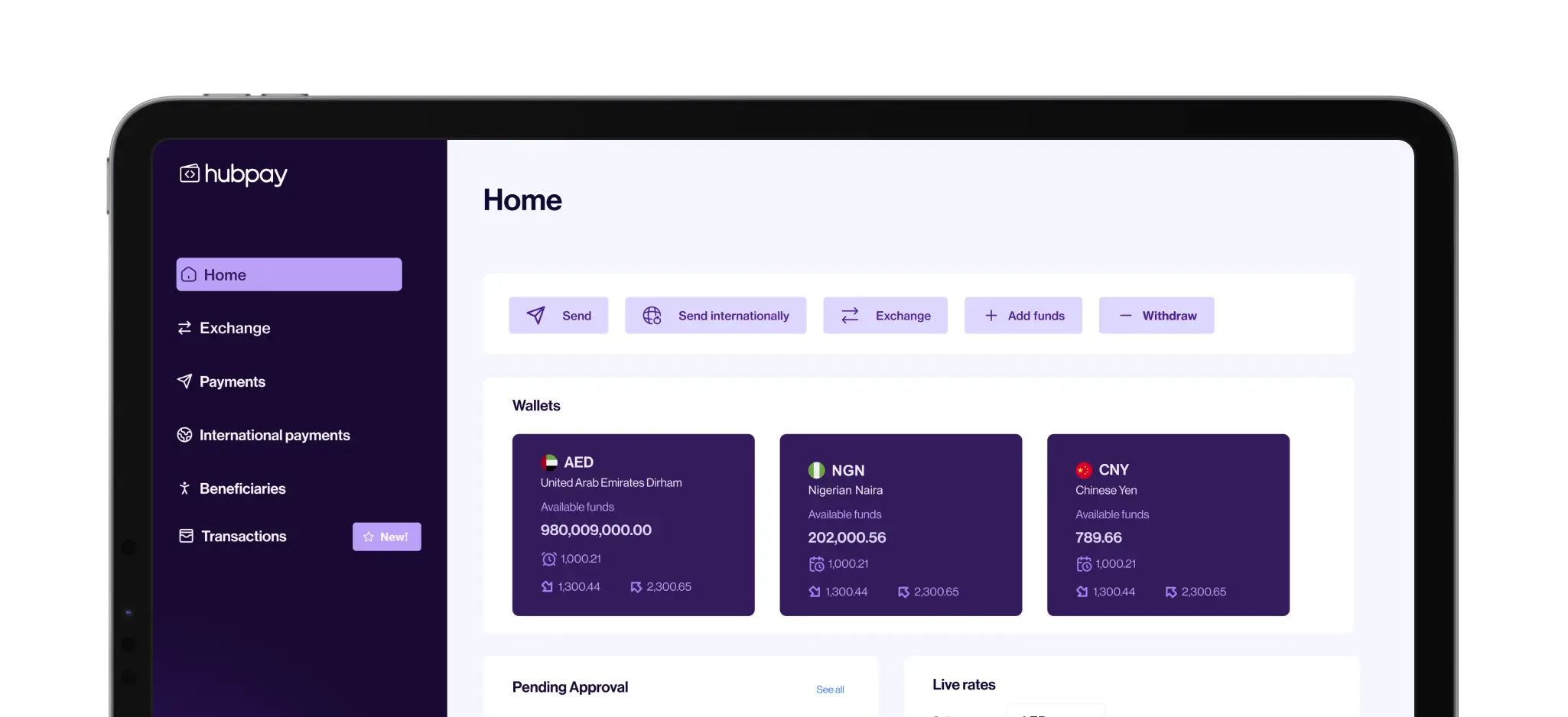

Hubpay Business Accounts remove these barriers with a faster, more affordable, and fully digital solution. Whether you are a startup, a growing company, or a large enterprise, Hubpay offers transparent pricing, competitive exchange rates, and seamless cross-border payments.

With features designed for modern businesses, Hubpay helps you move money globally without the usual delays and high costs. Instead of waiting days for a transaction to clear or struggling with unpredictable fees, you get a smarter, more efficient way to manage your business finances.

In this guide, we will explore five key features that make Hubpay the better choice for business payments. If you are ready to take control of your finances, read on.

Key Features of Hubpay Business Accounts

Transparent Pricing for Businesses of All Sizes

Unexpected fees can make it hard to manage business finances. Many financial service providers add hidden charges to transfers, currency exchanges, and account maintenance. These costs add up, reducing profits and making budgeting difficult.

Hubpay takes a different approach. With clear and upfront pricing, businesses always know what they are paying. Each plan is designed to fit different business needs, so whether you are a startup, a growing company, or a large enterprise, there is a cost-effective option for you.

Starter Plan (AED 99 per month)

This plan is ideal for startups and small businesses looking for an affordable way to manage global transactions. Businesses can send and receive up to $30,000 per month using a Named Virtual IBAN in AED. The account includes access to over 40 currencies and supports up to two users. International payments come with a flat fee of AED 26.

Scale Plan (AED 299 per month)

Growing businesses need more flexibility to handle higher transaction volumes. This plan allows businesses to send and receive up to $200,000 per month with Named Virtual IBANs in AED, USD, EUR, GBP, AUD, and CAD. It includes unlimited users and access to 145 currencies. International payments are charged at AED 52.50 (SHA) or AED 65 (OURS).

Treasury Plan (Custom Pricing)

Large enterprises with high transaction volumes need a solution that fits their scale. This plan includes a dedicated relationship manager, custom FX pricing, and forward contracts for better currency management. Businesses also benefit from free local payments and unlimited users.

Why it matters

With clear and predictable pricing, businesses can plan finances with confidence. No hidden costs mean no surprises, allowing companies to focus on growth instead of unexpected fees.

Virtual IBANs in Major Currencies

Managing international payments should not require multiple accounts in different countries. Traditional financial providers often make businesses open separate accounts for each currency, leading to higher costs and complex financial management. This slows down transactions and creates unnecessary administrative work.

Hubpay’s Virtual IBANs offer a better way to handle cross-border payments. With a single business account, companies can send, receive, and hold multiple currencies without the stress of managing separate banking relationships.

What businesses get with Virtual IBANs

A Named Virtual IBAN in key global currencies, including AED, USD, EUR, GBP, AUD, and CAD

Faster international payments through local banking networks

Seamless reconciliation by matching incoming payments with invoices

For businesses working with international clients and suppliers, Virtual IBANs simplify global transactions. Instead of waiting for delayed bank transfers or dealing with high conversion fees, businesses can process payments faster and at lower costs.

Why it matters

A single account with multi-currency support gives businesses more control over their finances. It eliminates the need for multiple accounts, reduces transaction fees, and improves cash flow management. With Hubpay, businesses can focus on growth without being held back by outdated payment systems.

Competitive Pricing Compared to Traditional Providers

High transaction fees and hidden charges make global payments expensive. Many financial service providers add markups to currency exchange rates and charge unpredictable fees, making it difficult for businesses to plan their expenses. These extra costs reduce profits and slow down international growth.

Hubpay offers a cost-effective alternative. With competitive exchange rates and clear pricing, businesses always know what they are paying. There are no inflated markups or unexpected deductions. Every transaction is processed at fair rates, helping businesses save money on international payments.

The Hubpay Advantage

Competitive exchange rates with no hidden markups

Transparent transaction fees, so businesses know the exact cost of every payment

Faster cross-border transactions, reducing processing delays and improving cash flow

By lowering the cost of international payments, Hubpay helps businesses improve their bottom line. Instead of spending more on fees, companies can reinvest their savings into growth. Whether paying international suppliers or receiving funds from global clients, businesses get better value with every transaction.

Why it matters

Reducing financial costs means higher profits and better cash flow management. With clear pricing and real-time exchange rates, businesses gain more control over their international transactions. Hubpay ensures that payments are faster, more affordable, and free from unnecessary charges.

Risk Management Solutions Like Forward Contracts

Exchange rate fluctuations can turn a profitable deal into a financial loss. Businesses handling international payments often struggle with unpredictable currency movements, which can increase costs and reduce profits. Without a strategy to manage these risks, companies may face unexpected losses that affect their bottom line.

Hubpay offers forward contracts to help businesses gain more control over their currency exchanges. Instead of leaving transactions to market volatility, businesses can lock in exchange rates for future payments. This provides stability and predictability, allowing companies to plan ahead with confidence.

How Forward Contracts Work

Lock in a fixed exchange rate for a future transaction

Reduce exposure to sudden currency fluctuations

Improve cash flow planning by knowing exact costs in advance

This solution is ideal for businesses making regular cross-border payments, as it removes uncertainty and protects against market swings. Instead of worrying about unfavorable exchange rates, companies can focus on growth and expansion.

Why it matters

A stable exchange rate helps businesses control costs and maintain predictable pricing. With Hubpay’s risk management solutions, companies can safeguard their profits and operate with greater financial confidence.

Fully Digital Onboarding

Opening a business account should not take weeks. Many financial institutions require in-person visits, extensive paperwork, and long approval times. These delays can slow down business operations and create unnecessary obstacles for companies looking to scale.

Hubpay offers a fully digital onboarding process, allowing businesses to set up their accounts in just 24 hours. There are no physical branch visits or complicated forms. Everything is handled online for a smooth and hassle-free experience.

How it works

Quick online registration with a simple application process

Easy document uploads directly from a secure drive

Dedicated support to assist businesses every step of the way

With fast account activation, businesses can start sending and receiving payments without unnecessary waiting times. Whether a company is a startup or an established enterprise, getting access to global financial services should be simple and efficient.

Why it matters

Time is money, and delays in account setup can slow down business operations. Hubpay eliminates unnecessary steps, ensuring that businesses can go live quickly and focus on what matters most—growing their business.

Final Thoughts

Managing business finances should be simple, fast, and cost-effective. Traditional financial providers often slow things down with high fees, delayed payments, and complicated processes. Hubpay offers a smarter solution, designed to help businesses save time and money while expanding their global reach. With transparent pricing, Virtual IBANs, and real-time exchange rates, businesses can move money across borders without hidden costs or delays.

Forward contracts provide protection against currency fluctuations, while fully digital onboarding ensures that businesses can start transacting in just 24 hours. Whether you are a startup, a growing company, or a large enterprise, Hubpay provides the tools to manage international payments efficiently. Stop dealing with unpredictable fees and slow transactions. Open a Hubpay Business Account today and take full control of your financial operations. The faster, smarter, and more affordable way to handle global payments is just a few clicks away.

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.