Foreign Currency Accounts vs. Multi-Currency Accounts: Which One is Right for You?

Learn the differences between foreign currency and multi-currency accounts. Discover which one suits your global financial needs and simplifies transactions.

Published on 4 February 2025

5 minutes read

As global transactions become a routine part of personal and professional life, financial tools like foreign currency accounts and multi-currency accounts have emerged to simplify international money management. While both options cater to people dealing with multiple currencies, they serve slightly different purposes.

In this article, we’ll dive deep into the distinctions between foreign currency accounts and multi-currency accounts, helping you understand which option aligns better with your needs. By the end, you’ll have a clear idea of how these tools can fit into your global financial strategy.

Understanding Foreign Currency Accounts

A foreign currency account is designed to hold, send, and receive funds in a single foreign currency. For instance, if you often deal in AED but live in a country where the local currency is different, a foreign currency account allows you to bypass constant conversions.

Key Features

Holds funds in one currency (e.g., AED, EUR, GBP, etc.).

Eliminates conversion fees when receiving or sending funds in that currency.

Simplifies transactions for frequent business dealings or travel in a specific country.

Foreign currency accounts are particularly beneficial for individuals or businesses that regularly interact with a single currency. However, they lack the flexibility to manage multiple currencies simultaneously.

Introducing Multi-Currency Accounts

Multi-currency accounts take the concept of foreign currency accounts a step further by allowing users to hold, send, and receive multiple currencies in one account. Instead of opening a separate account for each currency, you can manage several currencies under one umbrella.

Key Features

Holds funds in multiple currencies at once.

Enables seamless transfers between currencies without opening separate accounts.

Offers consolidated access to your global funds through a single dashboard.

This functionality makes multi-currency accounts ideal for people or businesses juggling payments in several currencies, providing unparalleled convenience.

How They Compare: Foreign Currency Accounts vs. Multi-Currency Accounts

Let’s break down the major differences between these two account types based on various factors:

1. Currency Flexibility

Foreign Currency Account: Suitable if you deal primarily in one foreign currency. For example, a business that invoices clients exclusively in euros would benefit from a euro-denominated account.

Multi-Currency Account: Perfect for those dealing with multiple currencies. A digital nomad earning in USD, paying for services in EUR, and traveling in Asia (requiring local currencies) would find a multi-currency account invaluable.

2. Convenience

Foreign Currency Account: Requires opening separate accounts for each currency. This can be cumbersome for individuals or businesses managing multiple currencies.

Multi-Currency Account: Combines all currencies into one account, offering a streamlined and efficient solution.

3. Fees

Foreign Currency Account: Conversion fees are avoided within the account’s designated currency. However, fees may apply when dealing with other currencies.

Multi-Currency Account: Offers reduced fees for transactions across supported currencies, especially if the account provider has favorable exchange rate policies.

4. Target Audience

Foreign Currency Account: Best for businesses or individuals with predictable currency needs, such as importing goods from a single country.

Multi-Currency Account: Suited for travelers, freelancers, global businesses, and anyone handling multiple currencies regularly.

Why Choose a Multi-Currency Account?

1. Comprehensive Currency Management

One of the standout features of a multi-currency account is the ability to manage funds in multiple currencies simultaneously. This is particularly advantageous for:

Freelancers working with clients from various countries.

Small businesses paying suppliers in different currencies.

Travelers who want to avoid repeated trips to currency exchange counters.

2. Seamless Currency Conversion

Many multi-currency accounts offer real-time currency exchange within the account. This feature allows you to convert currencies at competitive rates, giving you the flexibility to act when exchange rates are most favorable.

3. Consolidated Financial Overview

With all your funds under one roof, you gain better visibility and control over your finances. You can easily allocate currencies for specific purposes, such as business expenses, travel budgets, or savings goals.

Situations Where a Foreign Currency Account is Ideal

While multi-currency accounts shine in many scenarios, foreign currency accounts still hold their ground in specific use cases:

1. Focused Currency Transactions

If your financial interactions are limited to a single currency, a foreign currency account is simpler and more straightforward. For instance:

A student studying in the US might use a USD account to handle tuition fees and living expenses.

A business owner importing goods exclusively from the UK can use a GBP account for payments.

2. Long-Term Currency Holding

Foreign currency accounts are excellent for holding funds in a specific currency for long periods, especially if you’re waiting for favorable conversion rates or managing investments in that currency.

How Fintech is Redefining Multi-Currency Accounts

The rise of financial technology (fintech) has brought significant innovation to multi-currency accounts. Digital-first providers now offer features that make these accounts more accessible and affordable than ever before.

1. Low Fees and Transparent Pricing

Traditional banks often charge high fees for foreign currency and multi-currency accounts. Fintech platforms, on the other hand, offer reduced fees and transparent exchange rates.

2. Real-Time Global Access

Many fintech platforms offer robust mobile apps that let you manage your funds on the go. Whether you’re traveling or working remotely, you can check balances, transfer money, and convert currencies in seconds.

3. Integration with Payment Platforms

Modern multi-currency accounts often integrate with popular payment systems like PayPal, Stripe, or Apple Pay, simplifying global payments for businesses and freelancers.

Deciding Between a Foreign Currency Account and a Multi-Currency Account

The choice between a foreign currency account and a multi-currency account ultimately depends on your specific needs. Consider these questions when making your decision:

1. How Many Currencies Do You Use?

If you deal with one primary currency, a foreign currency account may suffice.

If you interact with multiple currencies, a multi-currency account is the better choice.

2. What’s Your Volume of Transactions?

High volumes in a single currency are better handled with a foreign currency account.

Diverse and frequent transactions in multiple currencies align well with a multi-currency account.

3. Do You Prioritize Simplicity or Versatility?

Foreign currency accounts offer simplicity for single-currency needs.

Multi-currency accounts provide versatility and a consolidated solution for global finances.

The Best of Both Worlds

In some cases, a combination of both account types might be ideal. For example:

A business might use a foreign currency account for predictable, high-volume transactions in a single currency while maintaining a multi-currency account for ad-hoc international payments.

A traveler could use a multi-currency account for global trips and a foreign currency account to hold funds in a frequently used currency, like USD.

Choosing the Right Tool for Your Global Financial Needs

Whether you choose a foreign currency account or a multi-currency account, both tools offer unique advantages tailored to different financial scenarios. Foreign currency accounts provide simplicity and cost-saving benefits for focused currency needs, while multi-currency accounts deliver unmatched versatility for managing global finances.

With the right account in place, you can save money, reduce complexity, and take control of your international transactions. Take the time to assess your needs, compare providers, and find the solution that fits your lifestyle or business goals.

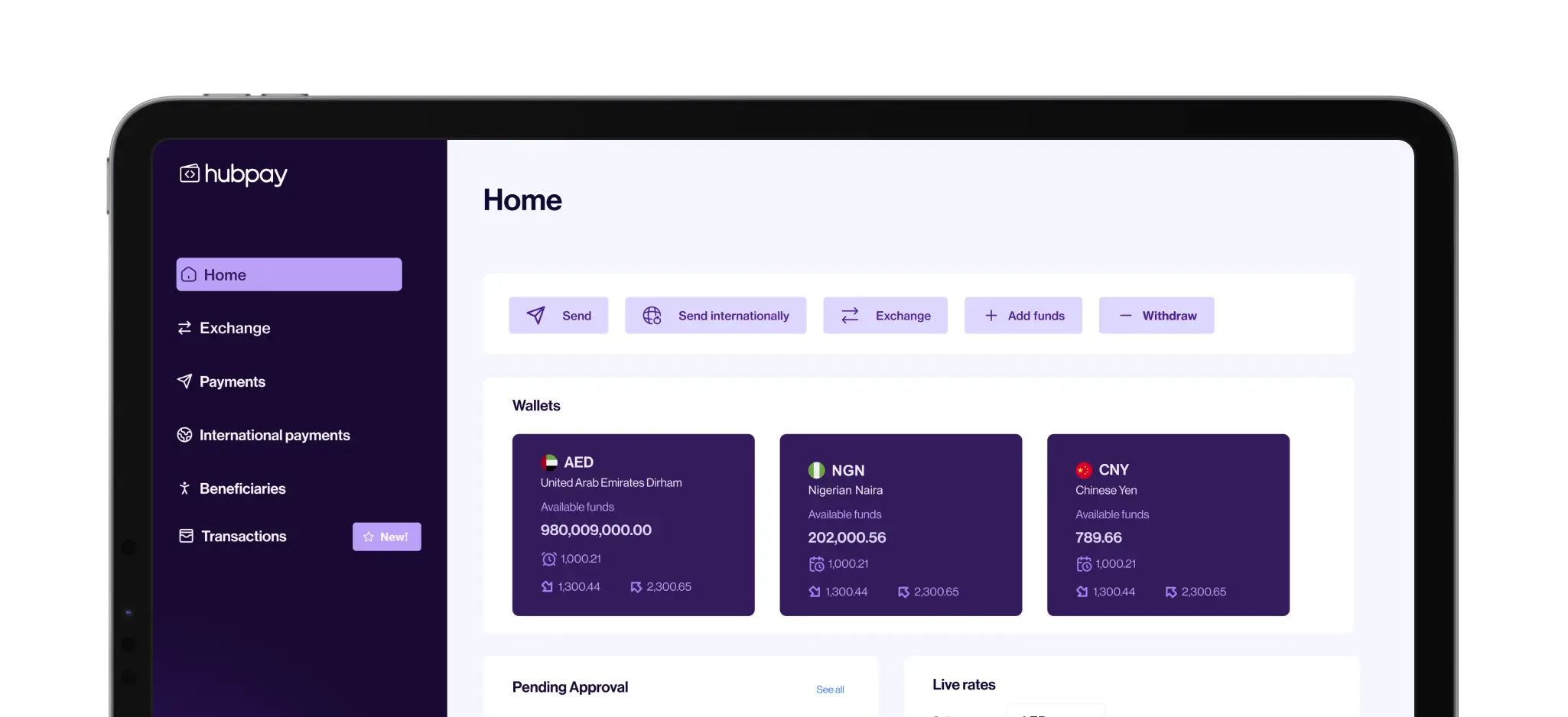

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.