How to Get a GBP IBAN in the UAE | Hubpay for UAE Businesses

Discover how UAE businesses can open a GBP IBAN instantly with Hubpay. Accept payments from the UK, convert GBP at top FX rates, and simplify trade with Britain.

Published on 26 May 2025

5 minutes read

How to Get a GBP IBAN in the UAE Instantly

Accept UK Payments Without Delays, High Fees, or Paperwork

As the UAE strengthens its trade ties with the United Kingdom — worth over AED 37.1 billion in non-oil trade in 2024 more businesses are seeking a fast, cost-efficient way to receive GBP payments.

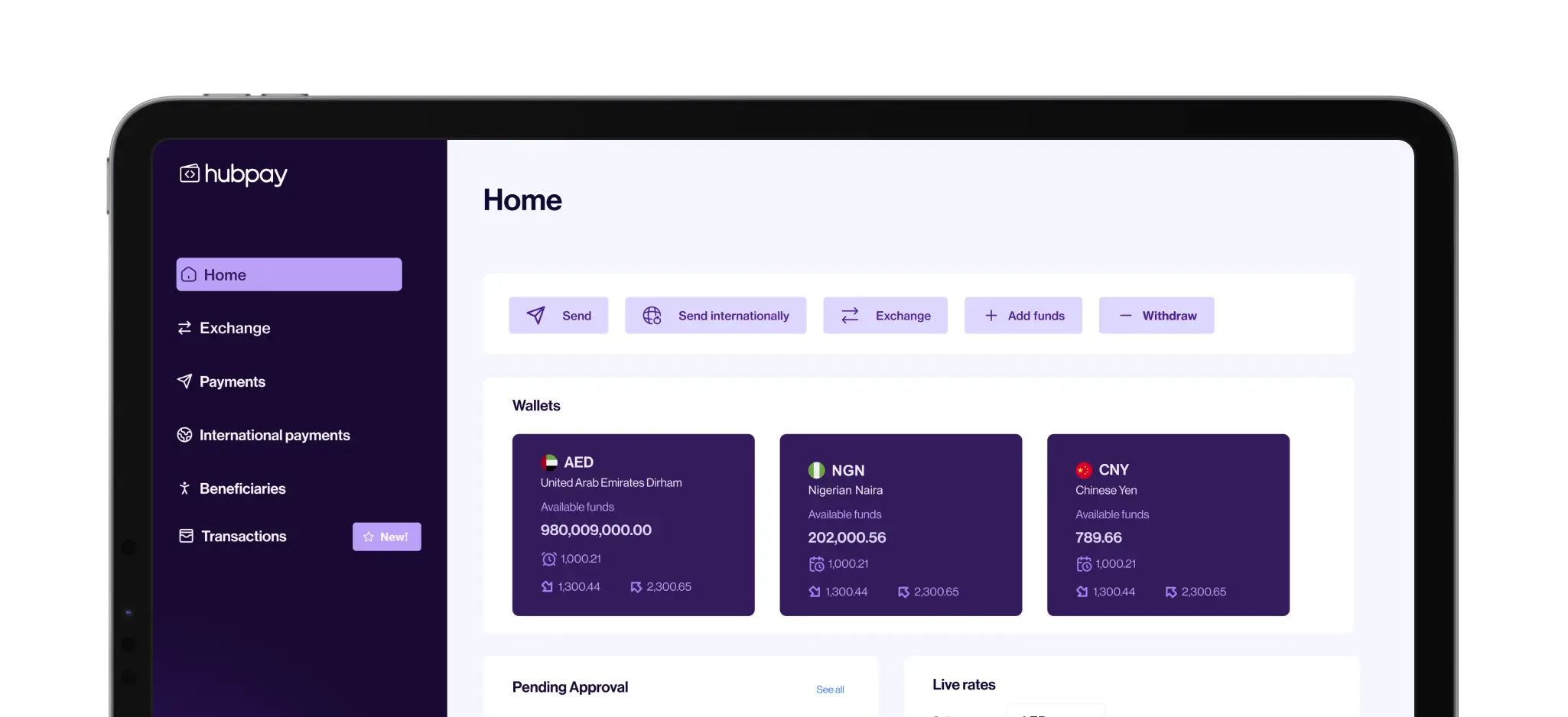

Enter Hubpay’s GBP IBAN account.

With Hubpay, UAE businesses can now open a named GBP IBAN within a single business day, no minimum balance, no lengthy credit checks.

Whether you're a trading company importing from the UK, a tech firm working with British partners, or a real estate business servicing UK investors, a GBP IBAN unlocks faster payments and better FX rates.

What Is a GBP IBAN?

A GBP IBAN (International Bank Account Number in British Pounds) allows your business to receive payments from UK-based clients via local UK rails or SWIFT.

It’s a secure, internationally recognized bank account format that streamlines cross-border transfers.

💡 Not sure how IBANs work? Check out this IBAN guide from Wise

Example of a Hubpay EUR IBAN:

Why UAE Businesses Need a GBP IBAN

Traditional banks in the UAE often create major bottlenecks:

❌ High minimum balance requirements

❌ Long onboarding timelines (up to 6 months)

❌ Third-party intermediary fees for UK payments

With Hubpay’s GBP IBAN solution, you can:

✅ Receive payments from UK clients directly in GBP

✅ Avoid costly conversion fees

✅ Convert at real mid-market FX rates

✅ Make outward GBP payments easily

The Hubpay Advantage: GBP IBANs Built for Speed & Scale

✅ Named GBP IBAN Account

Get a dedicated IBAN under your company name essential for credibility when dealing with UK businesses.

✅ Same-Day Setup

Sign up for a Scale or Treasury account, and start receiving GBP payments from day one.

✅ Hold & Convert GBP

Store your funds in GBP or convert them to AED, EUR, USD or 150+ currencies instantly.

✅ Powerful FX Tools

Use forward contracts and real-time FX to lock in your margins when converting GBP.

Ideal for UAE Businesses That Trade with the UK

Our GBP IBANs are perfect for businesses across sectors such as:

General Trading

Logistics & Freight

Professional Services

Real Estate Agencies

Luxury Retail

E-commerce

If you frequently invoice UK clients or suppliers, a GBP IBAN is a must.

How to Get Started

Setting up your GBP IBAN is simple:

Create a Hubpay Business Account

Choose a Scale or Treasury plan

Complete quick onboarding

Get your named GBP IBAN within 1 business day

Start receiving and sending GBP — with zero hassle

💼 Need multi-currency access? Learn how to get a EUR IBAN in the UAE.

Frequently asked questions

Ready to Open a GBP IBAN in the UAE?

Start receiving UK payments in GBP, without the friction of traditional banks.

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.