Shield your business from currency fluctuations with Hubpay’s Forward Contracts. Lock in exchange rates, protect profit margins, and manage cash flow with ease. Learn more today!

Published on 6 February 2025

2 minutes read

For businesses dealing with international transactions, currency fluctuations can be a major challenge. A sudden rise in exchange rates can erode profit margins, disrupt cash flow, and create financial uncertainty.

To help businesses navigate these risks, Hubpay has launched an automated hedging solution through Forward Contracts—giving you predictability, stability, and control over your foreign exchange transactions.

What is a Forward Contract?

A Forward Contract is a financial agreement that allows businesses to lock in an exchange rate today for a transaction that will take place in the future. This ensures that no matter how the market moves, your rate remains fixed, protecting you from unexpected losses.

Example Scenario:

Imagine your business imports goods from Europe and needs to pay €500,000 in three months. If exchange rates fluctuate, you could end up paying significantly more than planned. With Hubpay’s Forward Contract, you can secure today’s rate, ensuring price certainty and protecting your cash flow.

Hubpay’s Forward Contract Options

We offer two types of Forward Contracts to match different business needs:

Fixed Forward Contract

Ideal for businesses with a fixed payment date.

You lock in a rate today and use the contract on the maturity date.

Protects against sudden currency fluctuations.

Window Forward Contract

Provides flexibility—you can draw down funds at any time within a set period.

Ideal if you need multiple payments over time instead of a single fixed date.

Helps with cash flow management while still securing a stable exchange rate.

Why Hubpay’s Hedging Solution Stands Out

Unlike traditional banking solutions that require large deposits and lengthy processes, Hubpay makes hedging accessible to SMEs with:

Minimal Deposit Requirement: Secure a contract with just 5-10% of the total amount, freeing up capital for other business needs.

Real-Time Exchange Rate Locking: Instantly lock in rates with a transparent, easy-to-use digital platform.

Flexible Rollover & Drawdown Options: Need more time? Extend your contract period if needed (subject to market conditions).

Risk Management for Every Business Size: Unlike banks that offer FX hedging mainly to large enterprises, Hubpay makes this tool available to SMEs and mid-sized businesses.

Automated & Digital Process: Forget paperwork and manual approvals—our system is designed for fast and seamless execution.

The Real Cost of Not Hedging

Many businesses underestimate currency risk, assuming small fluctuations won’t make a big difference. However, even a 2-3% shift in exchange rates can mean thousands in unexpected costs.

The biggest risk? Profit margin erosion.

If the currency you need becomes more expensive, you either absorb the extra cost (reducing profitability) or increase prices, making you less competitive.

Hubpay’s Forward Contracts eliminate this uncertainty, giving you full cost visibility and financial stability.

How to Get Started

Hubpay makes it easy for businesses to integrate hedging into their financial strategy:

Step 1: Credit Evaluation – Our team reviews your business and assigns a credit line.

Step 2: Secure a Forward Contract – Lock in your exchange rate with a small upfront deposit (5-10%).

Step 3: Use Funds When Needed – Whether using a Fixed Forward or Window Forward, you have full control over your hedged funds.

Secure Your Business Against Currency Volatility

Opening an Account

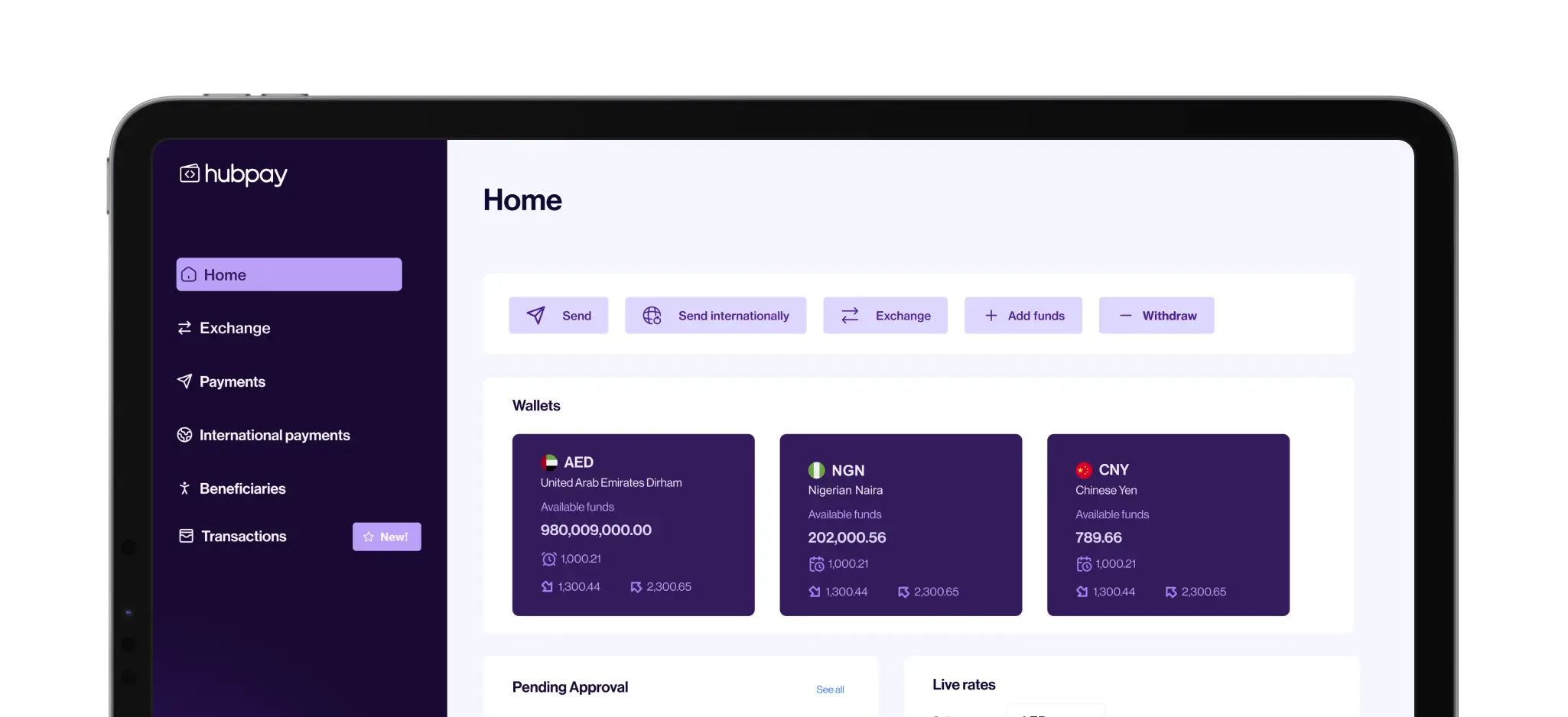

Setting up a Hubpay account is quick and straightforward. Provide your trade license and financial details, and your account will be ready for international use within a day.Managing Transactions

Use Hubpay’s dashboard to send and receive payments, view transaction history, and manage multi-currency accounts with ease.Reducing Costs

Leverage competitive exchange rates and low fees to keep more of your hard-earned revenue.Expanding Globally

With Hubpay, you can confidently grow your business into new markets, knowing your financial operations are streamlined and secure.

With Hubpay’s Automated Hedging Solution, you no longer need to gamble with exchange rates. Take control, protect your bottom line, and plan with confidence.

Want to learn more? Contact us today at wearehubpay.com

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.