Secure Payment Links for UAE Businesses | Hubpay

Accept card, bank, or crypto payments powered by Aquanow with the UAE’s first regulated Payment Link from Hubpay. Fast, secure, and built for business.

Published on 5 May 2025

5 minutes read

What Are Payment Links?

Payment links offer a simple and efficient way for businesses to receive payments quickly, securely, and without the need for any complex technical setup.

Instead of managing payment gateways, issuing invoices, or handling complicated integrations, you can just create a link, share it with your customer, and get paid. It really is that straightforward.

For high-value industries in the UAE such as real estate, shipping, and commodities trading, our payment links provide a faster, more flexible, and more secure alternative to traditional banking methods.

With Hubpay, sending payment links is easy. The link is delivered directly to the customer's email, allowing them to pay securely using a card, bank transfer, or even cryptocurrency.

What sets Hubpay apart is that it offers the first regulated payment link solution in the UAE. This means you get the combined benefits of security, speed, and convenience, all in one seamless platform.

In this blog, we’ll show you why Hubpay Payment Links are the smartest choice for your business in 2025.

Why UAE Businesses Need Smart Payment Links

In the UAE’s busy and constantly evolving business environment, payments need to keep up. That’s exactly where payment links make a difference.

Traditional payment systems are often slow, costly, and complicated. Setting them up might involve lengthy onboarding processes, technical integrations, or waiting for bank approvals. And when customers expect to pay with credit cards, bank transfers, or even crypto, things can get even more complicated.

But those outdated systems no longer meet today’s expectations.

Modern customers want a seamless payment experience. They expect instant, secure transactions with the flexibility to choose their preferred method. Whether that’s a card, a bank transfer, or a stablecoin. And they want the process to be simple, without any friction.

For businesses, this means it’s time for a smarter approach. One that’s quick to set up, easy to manage, and built to support modern payment demands.

Payment links are that solution. They offer flexibility and speed for a wide range of industries; from luxury retail and professional services to consultants and global entrepreneurs.

And when your payment links are powered by a regulated provider like ours, you’re not just processing payments, you’re building trust, ensuring security, and delivering a premium experience that customers will appreciate.

Meet Hubpay Payment Links: Fast, Flexible & Regulated

When it comes to collecting payments, Hubpay Payment Links handle the process efficiently so you don’t have to worry about anything.

You do not need any coding knowledge or technical expertise. The setup is simple, and the process is designed to help you get paid quickly from anywhere in the world.

To get started, you just upload your invoice, confirm the beneficiary details, and generate a payment link. Once you share the link, your customer can complete the payment using their preferred method, whether that is a card, a bank transfer, or cryptocurrency. The entire experience is seamless, secure, and built for flexibility.

Hubpay is proud to be the first regulated provider in the UAE offering this level of payment flexibility. This means every transaction you process through Hubpay Payment Links is backed by full regulatory compliance and advanced security standards.

UAE business owners use Hubpay to create secure payment links for transactions in AED, USD, EUR, GBP, and other major currencies. Whether the payment is made by card, bank transfer, or crypto, the process remains smooth and reliable.

These payment links are trusted across industries such as real estate, luxury retail, and high-end professional services. They fit naturally into your daily operations and are built to grow alongside your business.

With Hubpay, you gain a payment solution that empowers you to get paid on your terms.

How Hubpay Payment Links Work: Step-by-Step

Setting up payment links with Hubpay is fast, straightforward, and does not require any technical expertise.

Step 1: Open Your Hubpay Business Account

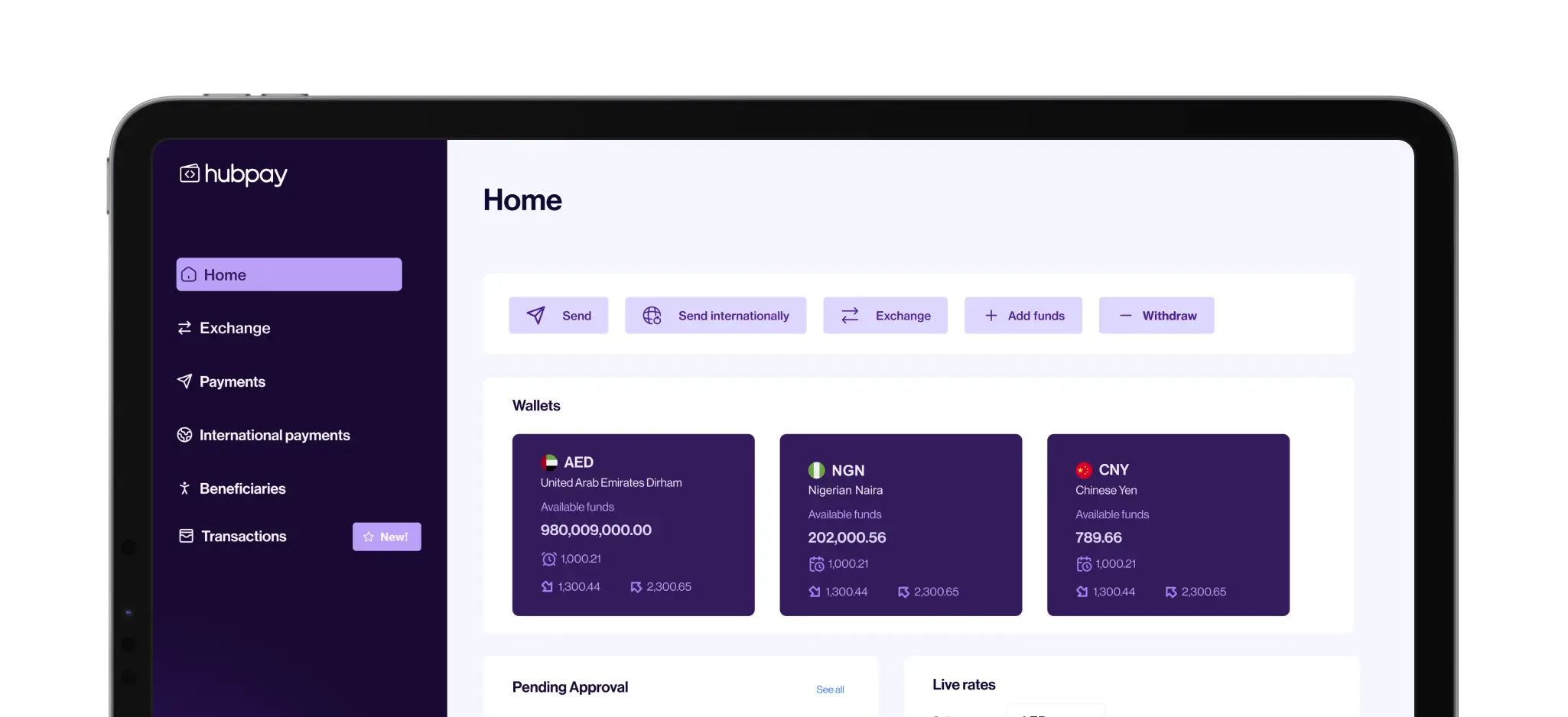

To begin, sign up for a Hubpay Business Account. The entire process is digital and usually takes just one business day to complete. After your account is verified, you will gain access to a multi-currency wallet that supports AED, USD, and over 150 other currencies.

Step 2: Create and Share Your Payment Link

Next, log in to your Hubpay dashboard. From there, upload your invoice and review key details such as the amount, payment description, and due date. Once everything looks good, generate your payment link.

You can then share the link with your customer by email. If you need support, Hubpay’s customer service team will respond within 24 hours.

Step 3: Get Paid and Track Everything

When your customer receives the payment link, they can choose how they want to pay. As soon as the payment is made, the funds are deposited directly into your Hubpay wallet.

You can track all transactions in real-time. Information about who paid, how they paid, and how much they paid is clearly displayed in one place.

With Hubpay, receiving payments through payment links is not only simple but also fully transparent and efficient.

Accepted Payment Methods with Hubpay Payment Links

Debit and Credit Cards

Hubpay Payment Links support payments made with Visa and Mastercard. This option is fast, secure, and well-suited for both online and remote transactions.

Bank Transfers

Customers can also pay using local bank transfers or international wire transfers. This method is especially useful for B2B transactions and high-value payments where traditional banking still plays a key role.

Crypto and Stablecoins

For businesses looking to operate globally, Hubpay makes it possible to accept cryptocurrency. Through a partnership with Aquanow, you can accept popular digital assets including:

USDT

USDC

Bitcoin (BTC)

Ethereum (ETH)

And other leading cryptocurrencies

What makes this even more convenient is that all crypto payments are instantly converted into AED or USD and settled directly in your Hubpay account.

By offering multiple payment options through a single platform, Hubpay Payment Links make it easier for your customers to complete transactions. This flexibility removes friction and opens more opportunities for your business to grow.

Transparent Pricing for Hubpay Payment Links

At Hubpay, pricing is designed to be straightforward and business-friendly. There are no subscription costs, no hidden fees, and no surprises. Just clear and transparent rates that support the needs of growing businesses in the UAE.

Here is what you can expect to pay when using payment links:

Card Payments (Visa and Mastercard)

For each successful transaction, the fee is 2.49% plus 1 AED.

If you need to issue a refund, a flat fee of 5 AED applies per refund.

In the case of a chargeback, the fee is 100 AED.

All fees listed are exclusive of VAT.

Crypto Payments (via Aquanow)

For cryptocurrency transactions, there is a flat fee of 1% per transaction.

Payments are instantly converted to either AED or USD and settled directly into your Hubpay account.

That’s all. There are no setup fees and no monthly maintenance charges.

Whether your business processes a few payments or handles hundreds each month, this transparent pricing model allows you to manage costs and plan for growth with confidence.

With Hubpay Payment Links, you only pay when you receive a payment, and you always have a clear understanding of the fees involved.

Secure and Compliant Payment Links You Can Trust

When dealing with money, trust is everything. That’s why Hubpay takes security and compliance seriously.

All payment links created through Hubpay follow strict compliance standards. Whether your customer pays by card, bank transfer, or crypto, their data stays protected.

Your business is protected too. Hubpay uses bank-grade security, encryption, and advanced fraud monitoring to keep your funds safe at every step.

Unlike many unregulated platforms, Hubpay was built for the UAE market and designed with regulation in mind from day one.

So when you use Hubpay Payment Links, you're not just getting paid faster. You're doing it safely, and with full compliance.

More Than Just Payment Links: Hubpay's Complete Business Suite

Hubpay offers much more than regulated payment links. It’s a full-service financial platform designed for ambitious businesses in the UAE and beyond.

Business Accounts

Get started with fast, paperless onboarding in under 24 hours. Hubpay’s business accounts come with no minimum balance requirements and transparent, tiered pricing to suit companies of every size.

Corporate FX & Treasury Management

Manage global cash flow with ease. Hold and exchange over 150 currencies at competitive FX rates. Access named virtual IBANs in major currencies like USD, EUR, GBP, and JPY. Plus, hedge your FX exposure to protect profits.

International Payroll

Run bulk payroll seamlessly across borders. Save on SWIFT fees with local payouts to 85+ countries. Just upload your payroll file and send thousands of payments in minutes accurately, efficient, and fully compliant.

Regulated Payment Links

Accept card, bank, and crypto payments with the UAE's first regulated payment link. Customers can pay via credit/debit card, bank transfer, or stablecoins like USDT and USDC. Powered by Aquanow, funds settle directly into your Hubpay account.

Ready to Simplify Payments for Your Business?

If you’re tired of dealing with clunky systems, delayed payments, or limited options, there’s a better way to handle it.

With Hubpay Payment Links, you can make the payment process easier for you and your customers. You’ll be able to:

Get paid through cards, bank transfers, or crypto

Offer more choice and flexibility at checkout

Receive funds quickly with full visibility into each transaction

Stay fully compliant with UAE regulations

Skip hidden fees, subscriptions, or monthly charges

It’s simple, efficient, and built for how business works today.

Create your first payment link today or schedule a demo with our team. Let Hubpay show you how easy modern business payments should be.

Frequently asked questions

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.