Discover how precious metals trading help preserve wealth and protect your portfolio from economic uncertainties.

Published on 10 February 2025

5 minutes read

The allure of precious metals lies not just in their aesthetic appeal but in their timeless ability to safeguard wealth. For centuries, metals like gold and silver have served as a hedge against economic uncertainties, providing stability where other assets falter. Today, in a world of fluctuating markets and volatile currencies, investing in precious metals for long-term wealth preservation remains as relevant as ever.

In this article, we’ll explore how precious metals fit into a wealth preservation strategy, why they are considered resilient assets, and how to build a portfolio that stands the test of time.

Why Precious Metals Are a Cornerstone of Wealth Preservation

Intrinsic Value

Unlike paper currencies or even digital assets, precious metals have intrinsic value. Their utility in industries such as electronics, jewelry, and manufacturing ensures consistent demand.

Historical Stability

Gold and silver have retained value through centuries of economic upheaval, wars, and financial crises. This track record positions them as reliable long-term assets.

Independence from Financial Systems

Precious metals are not tied to any single government, economy, or institution. Their value is globally recognized, making them immune to localized economic shocks or currency devaluation.

Inflation Protection

Gold, in particular, has proven to be an effective hedge against inflation. When the purchasing power of fiat currencies erodes, precious metals often appreciate, preserving wealth.

Choosing the Right Precious Metals for Long-Term Investment

Each precious metal brings unique characteristics to a wealth preservation strategy. Here’s a closer look:

Gold

Role: The ultimate store of value, gold is ideal for long-term wealth protection.

Advantages: High liquidity, low volatility, and a strong reputation as a safe-haven asset.

Best for: Investors seeking stability during economic uncertainty.

Silver

Role: Combines industrial utility with investment appeal.

Advantages: Higher potential for growth compared to gold due to industrial demand.

Best for: Those looking for a versatile asset with growth potential.

Platinum and Palladium

Role: Niche investments driven by industrial applications, particularly in automotive and technology sectors.

Advantages: Price surges during periods of high industrial demand.

Best for: Investors with higher risk tolerance who want exposure to industrial trends.

Building a Portfolio for Long-Term Wealth Preservation

When incorporating precious metals into your portfolio, balance and strategy are key. Here’s how to approach it:

Allocate Strategically

Precious metals should complement other asset classes in your portfolio. A common allocation strategy is to dedicate 5–15% of your portfolio to metals, depending on your risk tolerance and financial goals.

Focus on Physical Ownership

For long-term wealth preservation, owning physical metals (like bullion or coins) can be advantageous. Physical gold and silver are immune to counterparty risk, ensuring your investment retains value regardless of financial institution performance.

Diversify Across Metals

Gold provides stability, while silver and platinum offer growth potential. Diversifying across multiple metals ensures a balanced portfolio that can weather different economic conditions.

Secure Your Holdings

Physical ownership comes with storage considerations. Options include:

Home Safes: Convenient but requires robust security measures.

Vault Storage: Offered by banks or private companies, ensuring higher security but with associated costs.

Allocated Accounts: Precious metals stored in your name, offering ownership clarity and high security.

How Precious Metals Perform in Economic Downturns

Precious metals shine brightest during periods of economic turbulence. Here’s why:

Safe-Haven Demand

In times of crisis, investors flock to gold and silver as a hedge against volatile stock markets and declining currencies.

Inverse Correlation with Equities

Gold prices often rise when equity markets fall, providing a natural hedge for diversified portfolios.

Resilience in Hyperinflation

During hyperinflationary periods, fiat currencies lose value rapidly. Precious metals, on the other hand, retain purchasing power, as seen during past global financial crises.

Historical Example: The 2008 Financial Crisis

During the 2008 crisis, gold prices surged as investors sought safety amid plummeting stock markets. Those who had allocated even a small portion of their portfolio to gold saw significant protection against losses.

The Role of Precious Metals in Intergenerational Wealth Transfer

Precious metals are not just for individual wealth preservation—they are an effective tool for transferring wealth to future generations. Here’s why:

Durability

Physical metals like gold and silver do not degrade over time, ensuring they remain valuable for decades or even centuries.

Universal Value

Precious metals are recognized and valued globally, making them ideal assets for heirs living in different countries.

Privacy and Autonomy

Unlike stocks or real estate, precious metals can be transferred privately, offering discretion and fewer bureaucratic hurdles.

Modern Options for Long-Term Precious Metals Investment

While traditional methods like buying bullion remain popular, modern options are making precious metals investment more accessible:

Gold-Backed Digital Currencies

Platforms now allow investors to buy gold-backed cryptocurrencies, combining the stability of gold with the flexibility of digital assets.

Precious Metals ETFs

Exchange-Traded Funds offer exposure to gold, silver, and platinum without the need for physical storage, making them a convenient option for long-term investors.

Fractional Investments

Digital platforms enable investors to buy small amounts of gold or silver, lowering the barriers to entry and making precious metals accessible to all.

Key Considerations for Long-Term Investors

Understand Market Dynamics

Precious metals prices are influenced by factors such as:

Geopolitical tensions.

Industrial demand.

Central bank policies.

Avoid Overtrading

Frequent buying and selling erodes returns through fees and taxes. For wealth preservation, focus on long-term holding.

Insure Your Holdings

If you’re storing physical metals, ensure they’re covered by insurance against theft or damage.

Think Beyond Gold

While gold is a cornerstone of wealth preservation, incorporating silver and platinum adds growth potential and further diversification.

The Future of Precious Metals in Wealth Preservation

As global economies face mounting challenges, the importance of precious metals in wealth preservation is expected to grow. Emerging trends include:

Sustainability and Ethical Sourcing

Demand for responsibly mined metals is rising, with consumers and investors prioritizing sustainability.

Technological Innovations

Blockchain technology is enabling secure and transparent trading of tokenized precious metals, opening new opportunities for long-term investors.

Broader Accessibility

Platforms offering fractional ownership and digital gold ensure that precious metals investment is no longer limited to the wealthy.

Precious metals have stood the test of time as reliable vehicles for long-term wealth preservation. Whether you’re looking to hedge against inflation, stabilize your portfolio, or create a legacy for future generations, gold, silver, and other metals offer unmatched stability and resilience.

By understanding their unique properties, allocating strategically, and leveraging modern tools, you can build a robust precious metals portfolio that safeguards your wealth for decades to come. As market uncertainties persist, now is the time to consider how these timeless assets can secure your financial future.

Are you ready to start investing in precious metals? Whether you prefer the traditional route of bullion or modern digital options, the right strategy can make all the difference. Start building your wealth preservation plan today!

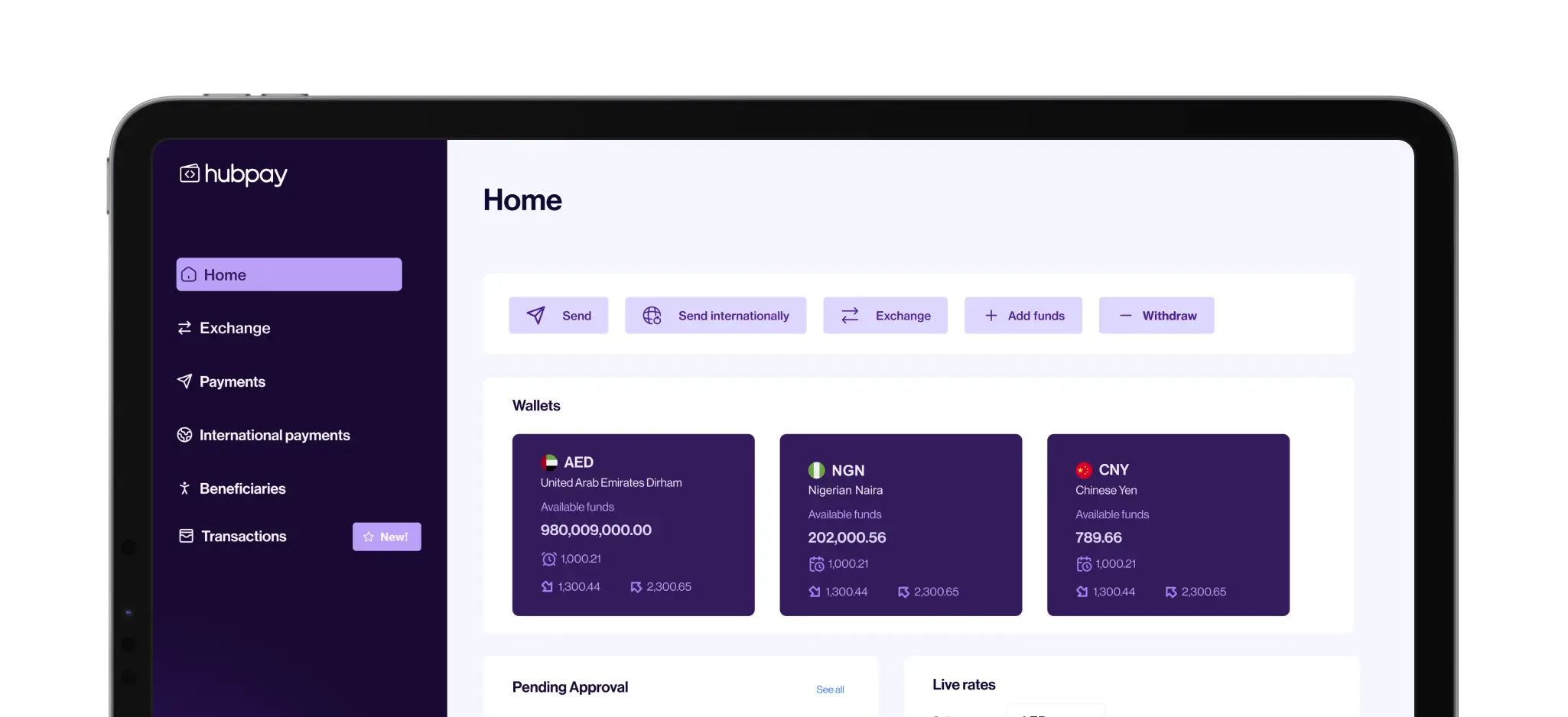

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.