Send Money from AED to AUD Fast | Hubpay for UAE Businesses

Convert AED to AUD with speed and security. Hubpay helps UAE businesses trade with Australia using fast payments, great rates, and same-day settlement.

Published on 16 April 2025

5 minutes read

AED to AUD payments have become a vital link in the booming trade relationship between the UAE and Australia. With two-way trade reaching $9.9 billion in 2023, more businesses than ever are exchanging goods and currency across borders.

As Australia’s top trade and investment partner in the Middle East, the UAE is importing critical Australian products like meat, dairy, coal, and minerals. This growth brings opportunity but also a need for fast, secure financial tools.

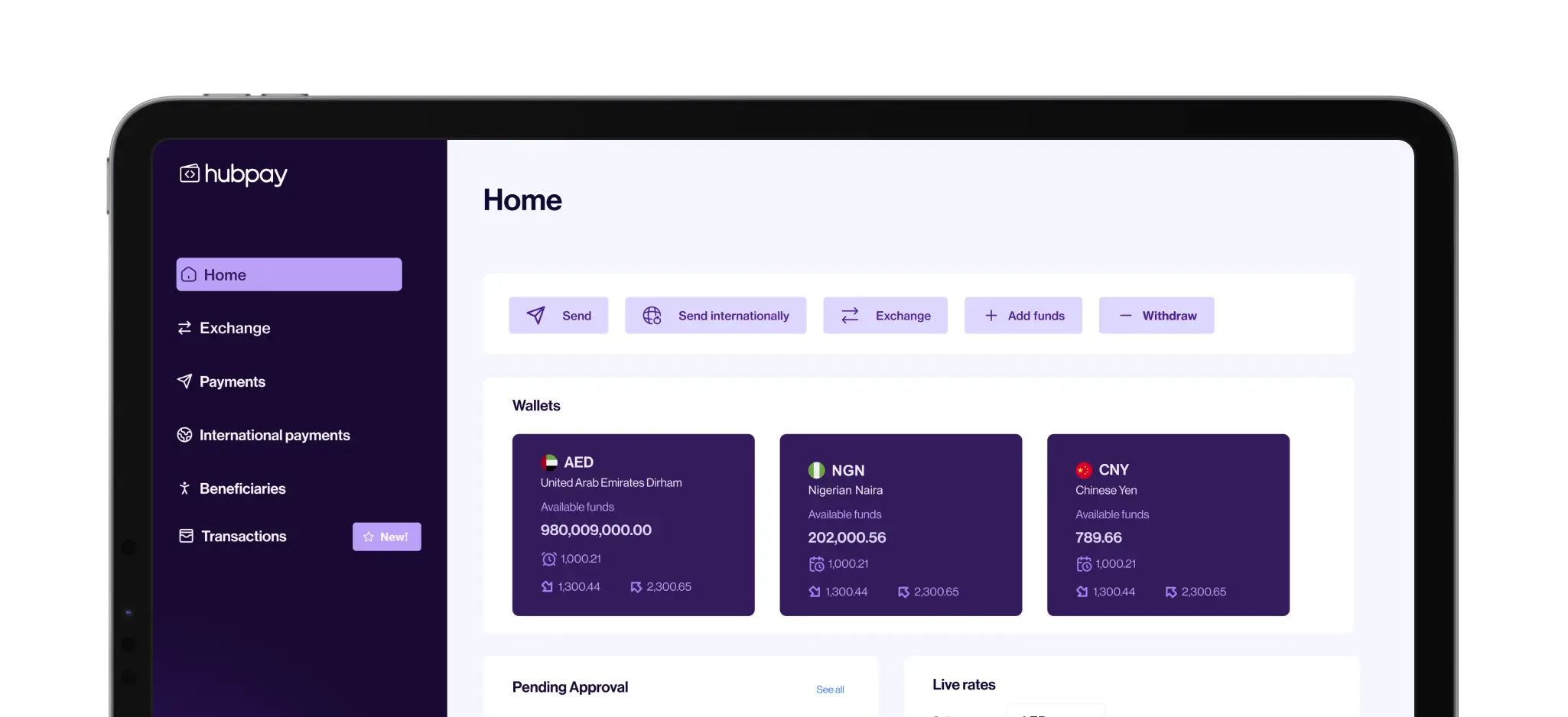

Enter Hubpay. We help UAE businesses move money in both AED and AUD with ease. Whether you're paying Australian suppliers or receiving funds from exports, Hubpay gives you the power to transact with confidence.

Our platform offers speed, security, and clarity; exactly what growing businesses need to stay ahead in today’s fast-paced market.

Start simplifying your payments today. Request a demo now.

Why AED to AUD Matters More Than Ever

In today’s trade-driven world, AED to AUD isn’t just a currency exchange, it’s a business-critical connection. For UAE companies trading with Australia, smooth and timely payments can make or break a deal.

Global trade moves fast. Delayed transactions or poor exchange rates can slow operations and reduce profits. That’s why businesses need payment solutions that work just as fast as they do.

With the growing trade volume between the two nations, the demand for reliable AED to AUD transfers has skyrocketed. Whether you're paying an Australian supplier or collecting export revenue, every second and every dirham counts.

Traditional banks often fall short. They come with delays, high fees, and limited visibility.

Hubpay steps in with a modern solution. We make sure your payments land quickly, securely, and at competitive rates, so your business can focus on growth, not red tape.

The Payment Challenges Businesses Face

Cross-border payments should be simple. But for many businesses, especially those dealing with AED to AUD transactions, they’re anything but.

Traditional banking systems weren’t built for the speed and scale of modern trade. Delays are common. Fees are high. And transparency? Often missing. You might send a payment today and not know when or how much your supplier will actually receive.

Foreign exchange rates can also work against you. Between hidden markups and currency fluctuations, businesses lose more than they should.

Managing payments across multiple currencies creates operational stress. Finance teams juggle paperwork, chase confirmations, and deal with outdated platforms.

And then there’s compliance. Staying on top of international regulations takes time and resources, something many growing businesses can’t afford to waste.

These challenges are real. But they’re also solvable with the right partner.

How Hubpay Solves It

When it comes to AED to AUD payments, Hubpay delivers exactly what today’s businesses need: speed, security, and simplicity.

First, let’s talk speed. Hubpay enables same-day settlement, so your money moves when you need it to, no more waiting days for international transfers to clear.

Next, transparency. You get competitive exchange rates with no hidden fees. What you see is what you get, so you can plan better and protect your margins.

Our platform is built for real businesses. That means multi-user access, maker-checker controls, and full visibility into every transaction. It’s financial clarity in real time.

Security is non-negotiable. Hubpay uses bank-grade protection, keeping your funds and data safe at every step.

And to top it off? Every client gets a dedicated account manager, a real person who understands your business and helps you succeed.

Whether you’re paying, receiving, or both, Hubpay makes AED to AUD cross-border payments frictionless.

Ready to streamline your payments? Book your demo today.

Benefits for UAE Businesses Trading with Australia

As trade between the UAE and Australia continues to accelerate, so does the need for smarter financial tools. For businesses that regularly send money to Australia from the UAE, choosing the right payment solution isn’t just a convenience, it’s a strategic advantage.

Recent global shifts, including U.S. tariffs, have added pressure to the AED to AUD exchange rate. These fluctuations can hit hard if your payments aren’t timed or managed properly. That’s why more UAE businesses are turning to Hubpay for a better way to manage cross-border transactions.

With Hubpay, you get access to features that make a real difference:

Same-day AED to AUD transfers: Keep your operations moving with fast, reliable payments.

Competitive exchange rates: Transparent pricing helps protect your profit margins.

Forward contracts for currency hedging: Lock in exchange rates to reduce your risk and plan ahead.

Multi-user access with approval workflows: Give your finance team the tools they need to stay in control.

Real-time transaction visibility: Track payments every step of the way, no more guesswork.

Dedicated account management: Get support from someone who understands your business and your market.

Enhanced security: Bank-grade protection keeps your funds and data safe at all times.

These features combine to offer more than convenience, they create confidence. With Hubpay, you can scale your trade operations without worrying about payment delays, FX risk, or compliance headaches.

Why Now Is the Time to Switch

The Australia-UAE trade corridor is thriving, but the financial tools many businesses use haven’t kept up. If you’re still relying on outdated systems to handle your AED to AUD payments, you're likely losing time, money, and opportunities.

Trade volumes are only going to rise. And with rising volumes come rising expectations, from suppliers, partners, and your own finance team. Speed, clarity, and control are no longer nice to have; they’re essential.

Traditional banks move slowly. They charge more. And they rarely give you the real-time insights you need to make confident decisions.

Hubpay is built for today’s fast-paced, global businesses. It’s modern, flexible, and made to grow with you. Whether you’re sending one payment a month or managing dozens each week, Hubpay gives you the control and transparency you’ve been missing.

Make the switch now and future-proof your payments.

Start Sending AED to AUD Payments the Smarter Way

The way you move money matters. Whether you're importing from Australia, exporting to it, or simply paying partners overseas, Hubpay gives your business the edge it needs to move faster, smarter, and more securely. No delays. No hidden fees. Just clean, efficient AED to AUD payments designed for modern trade. Thousands of businesses are already transforming the way they handle cross-border payments. Now it’s your turn.

Request a demo today and discover how Hubpay can streamline your global payments.

The future of finance is here and it’s built for your business.

Frequently asked questions

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.