Smart Payroll Solutions for UAE Businesses | Hubpay

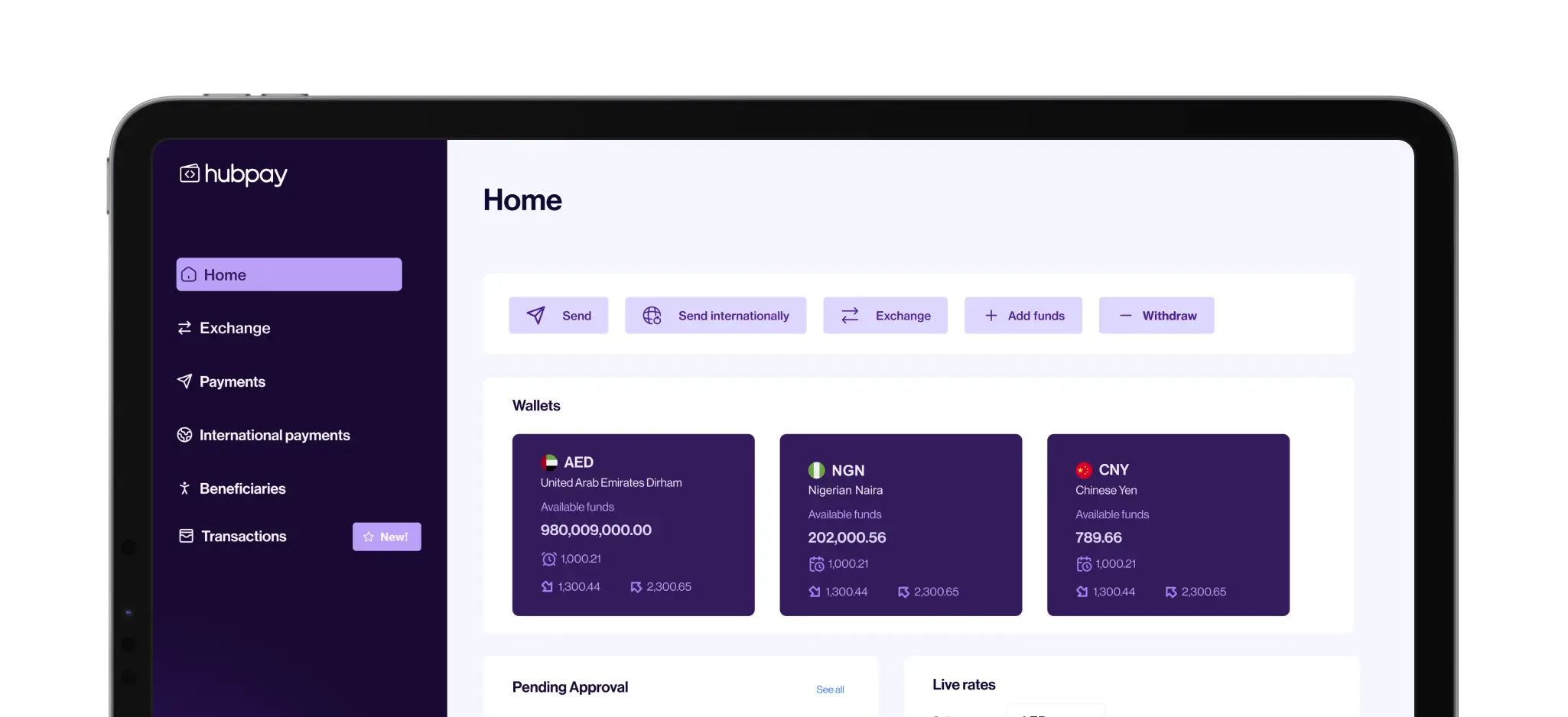

Streamline global payroll with Hubpay. Automate bulk uploads, mass payments, and enjoy competitive exchange rates, all with secure multi-currency solutions.

Published on 20 March 2025

4 minutes read

Smart Payroll Solutions for UAE Businesses | Hubpay

Managing international payroll is complex. Businesses struggle with currency exchange, compliance, and timely salary payments. But now, there’s a game-changer. Hubpay, a UAE Future100-listed fintech offers Payroll solution for business. It’s a seamless global payroll solution built for businesses paying employees worldwide.

The UAE’s payroll market is worth $1.2 billion. With businesses expanding globally, efficient multi-currency payroll solutions are essential. Hubpay Payroll makes cross-border payments faster, easier, and cost-effective. Companies can now pay employees in multiple currencies without hidden fees. The platform also offers bulk beneficiary uploads, mass payments, and competitive exchange rates.

Want a quick and stress-free payroll system? Hubpay Payroll is the answer. Keep reading to learn how it works and why your business needs it.

The Growing Need for Multi-Currency Payroll Solutions

The UAE has become a global hub for businesses with teams spread across the world, making payroll a major challenge. As companies expand internationally, hiring global talent is easier than ever.

However, managing multi-currency payroll is complex. Every country has unique tax laws, compliance rules, and banking systems. Payroll teams must navigate exchange rates, local regulations, and cross-border payments, where even small errors can lead to delays, fines, and dissatisfied employees.

Currency fluctuations add another layer of complexity. Exchange rates shift daily, and poor timing on salary payments can cost businesses thousands. A global payroll solution mitigates this risk by optimizing payment timing and reducing losses.

Compliance is also crucial. Each country enforces strict labor laws, tax regulations, and banking policies. Failing to adhere to these rules can result in hefty penalties. Handling this manually is inefficient and risky, making automation essential.

Delayed salaries impact employee morale and retention. Workers expect timely payments in their local currency. A seamless international payroll system ensures smooth, on-time transactions, keeping teams engaged and satisfied.

With UAE companies hiring teams across Europe, Asia, and Africa, the demand for multi-currency payroll solutions is increasing. Businesses need secure, cost-effective, and compliant ways to pay their global workforce. Hubpay Payroll streamlines cross-border payments, ensuring salaries are processed quickly, transparently, and without hidden fees.

Key Features of Hubpay’s Payroll Solution

Handling multi-currency payroll can be challenging, but our Payroll feature transforms it into a seamless process. It is designed for efficiency, reduces administrative burdens, and ensures compliance, so businesses can focus on growth instead of payroll complexities.

Bulk Beneficiary Upload

Adding employees manually is slow and frustrating. Hubpay Payroll lets businesses upload multiple employees using a CSV file. This feature saves hours of work and reduces errors, ensuring payroll accuracy.Mass Payments

Paying employees one by one is inefficient. With mass payments, businesses can send salaries to multiple employees in different countries at once. This ensures on-time salary disbursement with minimal effort.Competitive Exchange Rates

Currency conversion costs can eat into company profits. Hubpay Payroll offers transparent FX rates with no hidden fees, helping businesses save money on international payroll transactions.Regulatory Compliance

Compliance is crucial in global payroll. Hubpay Payroll follows FSRA regulations, ensuring full adherence to KYC and AML protocols. This keeps payroll transactions secure, legal, and hassle-free.

With these powerful features, Hubpay Payroll helps businesses streamline global payments with confidence. Start simplifying your payroll today—get in touch with us to learn more!

Hubpay: The All-in-One Payment Solution for UAE Businesses

Managing global payments is a challenge for businesses expanding across borders. From payroll to international transactions, companies need a seamless, secure, and cost-effective way to operate. Hubpay offers a comprehensive solution designed for UAE businesses hiring teams in Europe, Asia, and Africa.

Hubpay Business Accounts

Set up a business account in just one business day, enabling quick and hassle-free transactions for local and international payments.

Multi-Currency Virtual IBANs

With support for 150+ currency pairs, businesses can send and receive payments globally without unnecessary delays or high conversion costs.

International Payroll (Non-WPS)

For UAE businesses with teams overseas, Hubpay offers a compliant and cost-effective payroll solution, ensuring timely salary payments without hidden fees.

Crypto Payment Services

As the UAE’s first regulated crypto payment service, Hubpay allows businesses to accept crypto payments and convert them into USDT stablecoins, providing additional financial flexibility.

With transparent pricing, and a scalable platform, Hubpay helps businesses streamline financial operations while reducing administrative burdens and costs. Whether paying employees, managing transactions, or exploring new pay.

How to Get Started with Hubpay

To get started with Hubpay, follow these steps to open your Hubpay Business Account and start managing global payments effortlessly.

Step 1: Sign Up in Minutes

The first step is to visit the pricing page and choose your preferred business account. Hubpay makes registration quick and stress-free. Businesses are required to complete a short questionnaire, this takes just one minute and requires basic business information such as:

Business name and legal structure

Industry and nature of operations

Contact details and key representatives

Once submitted, you will move on to the verification process.

Step 2: Complete KYC and Upload Documents

To comply with financial regulations, Hubpay requires businesses to undergo Know Your Customer (KYC) verification. This step ensures secure transactions and compliance with anti-money laundering (AML) guidelines.

Businesses need to submit:

Trade License: Proof of business registration

Identification Documents: Passport or Emirates ID of key company representatives

Other Supporting Documents: Depending on your business type and jurisdiction, additional documents may be required

Hubpay’s team reviews submissions promptly, typically completing verification within one business day. If additional information is needed, businesses will be notified immediately to avoid delays.

Step 3: Start Using Hubpay’s Features

Once your account is approved, you can instantly access Hubpay’s suite of financial services, including:

Multi-Currency Virtual IBANs: Manage funds in 150+ currency pairs

International Payments: Send and receive payments seamlessly across Europe, Asia, and Africa

Automated Payroll: Set up salary payments for your global workforce in local currencies

Crypto Payments: Accept cryptocurrency payments and convert them to USDT stablecoins

Get started today by visiting the pricing page and unlocking a seamless global payment experience with Hubpay.

Conclusion

The way businesses manage international payroll is evolving. Companies can no longer rely on outdated, manual systems. The need for fast, secure, and compliant payroll solutions is greater than ever. With Hubpay Payroll, businesses can automate payments, reduce costs, and ensure compliance with ease. The platform is built for efficiency, scalability, and global reach.

Now is the time to embrace the future of payroll. Simplify global salary payments and focus on growing your business. Hubpay Payroll is ready, are you?

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.