How Stablecoin-to-Fiat Payments Are Transforming UAE–Africa Trade | Hubpay

Discover how Hubpay is helping UAE businesses trade with Africa using stablecoin-to-fiat solutions. Learn how USDT/USDC simplify payments, reduce costs, and ensure compliance.

Published on 21 June 2025

5 minutes read

How Stablecoin-to-Fiat Payments Are Powering UAE-Africa Trade

In today’s increasingly globalized trade environment, UAE businesses are expanding rapidly into emerging markets like Africa. From commodity traders to logistics firms, many are seeking faster, more reliable ways to send and receive payments across borders. However, Africa’s complex currency landscape and stringent capital controls are creating friction for legitimate payment providers. In this context, stablecoins have emerged as a transformative solution.

The State of Fiat Payments in Africa

Africa is home to some of the most expensive and volatile payment corridors in the world. According to the World Bank, sub-Saharan Africa remains the costliest region for sending remittances, with fees averaging 8.37% per transaction. These inefficiencies are worsened by capital controls and local currency devaluation. For example, in countries like Nigeria or Zimbabwe, converting USD into local currencies can take days and come with unofficial premiums exceeding 20%.

The Bankii blog highlights the broader financial exclusion across Africa, where over 350 million people remain unbanked and cross-border trade is burdened by slow settlements, regulatory hurdles, and steep forex costs. Businesses in the UAE trying to operate in these markets face similar roadblocks: slow delivery times, unreliable conversions, and opaque transaction processes.

Stablecoins: A Saving Grace for Cross-Border Trade

Stablecoins, digital assets pegged to fiat currencies like USD or AED, offer a modern alternative to traditional payment systems. Platforms such as Tether (USDT) and USD Coin (USDC) have emerged as reliable mediums for sending value across borders, without the price volatility of traditional cryptocurrencies.

As noted by Techpoint Africa, stablecoins are revolutionizing cross-border payments by slashing fees, improving speed, and providing a much-needed hedge against currency devaluation. A $10,000 payment routed through traditional banking channels might take 3–7 days and cost over $500 in fees, while stablecoins can deliver the same value in minutes with costs under 1%.

Even global players are joining the shift. DP World recently announced its plan to launch stablecoin-powered payment solutions to simplify international trade, particularly in Asia and Africa.

Challenges for UAE Businesses in Africa

Despite regulatory advancements in the UAE, including the approval of virtual asset frameworks by ADGM and VARA, many UAE businesses still face challenges when trading with African partners:

Volatile exchange rates make it difficult to settle in local currency profitably

Capital controls delay fund transfers and reduce liquidity

Rising unofficial markets (hawalas) risk compliance breaches

As a result, legitimate platforms like Hubpay find it increasingly difficult to compete with informal channels. Yet, the rise of regulated stablecoin infrastructure, such as the initiative announced by FAB, ADQ, and IHC, is shifting momentum back to transparent, compliant systems.

How Hubpay Is Helping

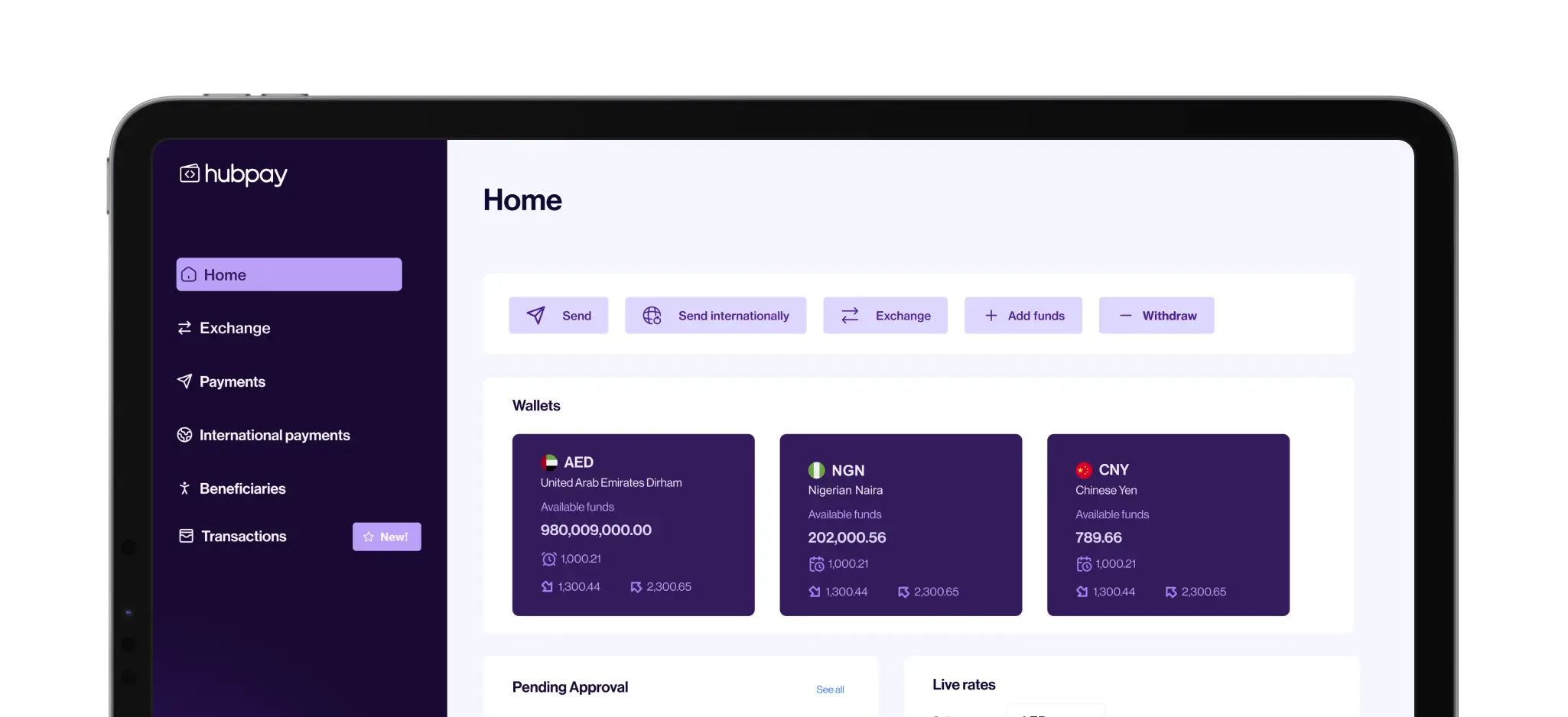

Over the past year, Hubpay has been helping UAE businesses navigate these complexities with compliant, cost-effective cross-border payment solutions:

We enable businesses to receive payments in local African currencies and remit USD directly into their Hubpay wallet in the UAE.

Conversely, we help clients send USD to Africa, where it is converted into local currencies and delivered to their beneficiaries.

With currency volatility and regulatory bottlenecks rising, we've seen increased demand for stablecoin-based alternatives. That’s why, through our partnership with Aquanow, Hubpay now offers:

On-ramp: UAE clients can convert AED/USD to USDT or USDC, which we deliver to partners across Africa and other emerging markets.

Off-ramp: Clients in Africa can send USDT/USDC via our regulated payment link, which we convert to AED/USD in real time and deposit into the client’s Hubpay wallet.

We’ve also implemented a four-step offline settlement process to ensure:

Reduced costs through margin efficiency

Faster settlement speeds

Secure, compliant transactions that meet UAE regulatory standards.

This has helped UAE firms across commodities, precious metals, agriculture, and general trading seamlessly continue business with African partners despite a challenging macro environment.

Ready to Streamline Your Africa Trade Payments?

Hubpay is your trusted partner in enabling compliant stablecoin-to-fiat payment flows between the UAE and Africa.

Book a demo to learn how we can help your business save on margins, speed up settlements, and stay compliant in global trade.

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.