Discover the fundamentals of precious metals trading, its benefits, and strategies to invest in gold, silver, and more.

Published on 14 February 2025

3 minutes read

Investing in precious metals trading has long been a popular choice for those looking to diversify their portfolios, hedge against inflation, or safeguard wealth during economic uncertainty. Whether you're a seasoned investor or a curious beginner, understanding how to trade precious metals effectively can open doors to a stable and potentially lucrative investment path.

This guide explores the world of precious metals trading, the key types of metals, their benefits, trading methods, and strategies to help you make informed decisions.

What Are Precious Metals?

Precious metals are rare, naturally occurring metallic elements that hold significant economic value due to their scarcity, utility, and historical role as a store of value. The most common precious metals traded include:

Gold: The go-to asset for hedging against inflation and economic crises.

Silver: Valued for both industrial applications and investment potential.

Platinum: Highly sought after in industrial applications like automotive manufacturing.

Palladium: A critical metal for the automotive and electronics industries.

These metals are traded in various forms, including physical bullion, futures contracts, and exchange-traded funds (ETFs).

Why Trade Precious Metals?

Hedge Against Inflation

Precious metals, particularly gold, are historically known for retaining value even during periods of high inflation. As fiat currencies lose purchasing power, precious metals often appreciate, offering a stable alternative.

Portfolio Diversification

Adding precious metals to your portfolio reduces risk by balancing out the volatility of equities or other high-risk assets. Diversification is critical for long-term financial stability.

Safe-Haven Assets

During times of political or economic turmoil, precious metals act as a refuge for investors. Their intrinsic value and global demand make them a trusted asset class in uncertain times.

Potential for High Returns

Silver, platinum, and palladium often experience price surges due to industrial demand, offering opportunities for short-term gains.

How to Trade Precious Metals

Trading precious metals can be done in several ways, each catering to different investor preferences and risk tolerances. Here’s a breakdown of the primary methods:

Physical Metals

This involves purchasing tangible forms of precious metals, such as coins, bars, or jewelry. Key considerations include:

Storage: You’ll need secure vaults or safes.

Liquidity: Selling physical metals can take time.

Premium Costs: Dealers charge premiums over the spot price.

Futures Contracts

Futures trading involves agreements to buy or sell a specific quantity of a metal at a predetermined price and date. It’s ideal for investors with experience in leveraged trading. However, futures contracts carry high risk and require active management.

Exchange-Traded Funds (ETFs)

ETFs allow you to invest in precious metals without physically owning them. They offer high liquidity and are traded on major stock exchanges. Popular options include SPDR Gold Shares (GLD) and iShares Silver Trust (SLV).

Mining Stocks

Investing in companies that mine precious metals provides indirect exposure to price fluctuations. Mining stocks can deliver high returns during metal price rallies but carry risks associated with company performance.

Digital Gold Platforms

In the digital era, platforms allow investors to buy fractional amounts of gold or silver online. These platforms provide convenience and lower barriers to entry.

Key Factors Influencing Precious Metal Prices

Understanding the factors that drive precious metal prices can help you anticipate market trends and make informed trading decisions. The following are the primary drivers:

Supply and Demand

Mining output, industrial usage, and investor demand significantly influence prices. For instance, increased demand for palladium in the automotive sector often leads to price spikes.

Geopolitical Events

Wars, trade disputes, and political instability often drive investors toward precious metals, leading to price increases.

Inflation and Interest Rates

Precious metals generally rise in value when inflation is high or when central banks lower interest rates, as lower yields make metals more attractive compared to bonds.

Currency Strength

A weaker US dollar typically boosts the prices of metals like gold and silver, as they are priced in dollars and become more affordable to investors using other currencies.

Strategies for Successful Precious Metals Trading

Set Clear Goals

Define your investment goals before diving in. Are you looking for a long-term hedge, short-term gains, or diversification? Clear goals will guide your trading decisions.

Understand the Market

Regularly analyze market trends, global events, and economic indicators that influence precious metals prices. Keeping a pulse on the market helps you time your trades effectively.

Choose the Right Platform

Selecting a reliable platform is crucial. Look for one that offers user-friendly interfaces, low transaction fees, and a secure environment for trading.

Start Small

Begin with modest investments, especially if you’re new to precious metals trading. Gradually increase your exposure as you gain experience and confidence.

Diversify

Avoid putting all your resources into one metal. Spread your investments across gold, silver, platinum, and palladium to minimize risks and maximize opportunities.

Leverage Stop-Loss Orders

When trading futures or ETFs, use stop-loss orders to limit potential losses. This ensures you don’t lose more than your set tolerance.

Risks to Consider in Precious Metals Trading

While trading precious metals can be rewarding, it’s not without its risks. Be mindful of the following:

Volatility: Prices can be affected by sudden geopolitical or economic events.

Storage Costs: Physical metals require secure storage, which incurs additional expenses.

Counterparty Risk: Trading on unreliable platforms or investing in mining stocks with weak fundamentals can lead to losses.

Opportunity Cost: Precious metals don’t generate income like dividends or interest, which could make other investments more attractive over time.

The Future of Precious Metals Trading

As global economies face increasing uncertainties, the demand for precious metals is likely to remain robust. Additionally, emerging technologies like blockchain are revolutionizing how investors access and trade metals. For instance, tokenized gold allows fractional ownership, making the asset class more accessible to younger, tech-savvy investors.

Sustainability concerns may also reshape the market. Ethical mining practices and the recycling of precious metals are becoming essential considerations for environmentally conscious investors.

Precious metals trading is an excellent way to safeguard your wealth, diversify your portfolio, and potentially earn attractive returns. By understanding the types of metals, trading methods, and market dynamics, you can navigate this timeless asset class with confidence.

Whether you're investing in gold for stability, silver for industrial demand, or platinum and palladium for growth potential, the key is to approach the market with a clear strategy, informed decision-making, and awareness of the associated risks.

With the right tools and knowledge, you can make precious metals a valuable part of your financial journey.

Are you ready to start exploring precious metals trading? The time-tested appeal of these assets makes them an ideal choice for savvy investors in any market environment. Start small, stay informed, and invest with purpose!

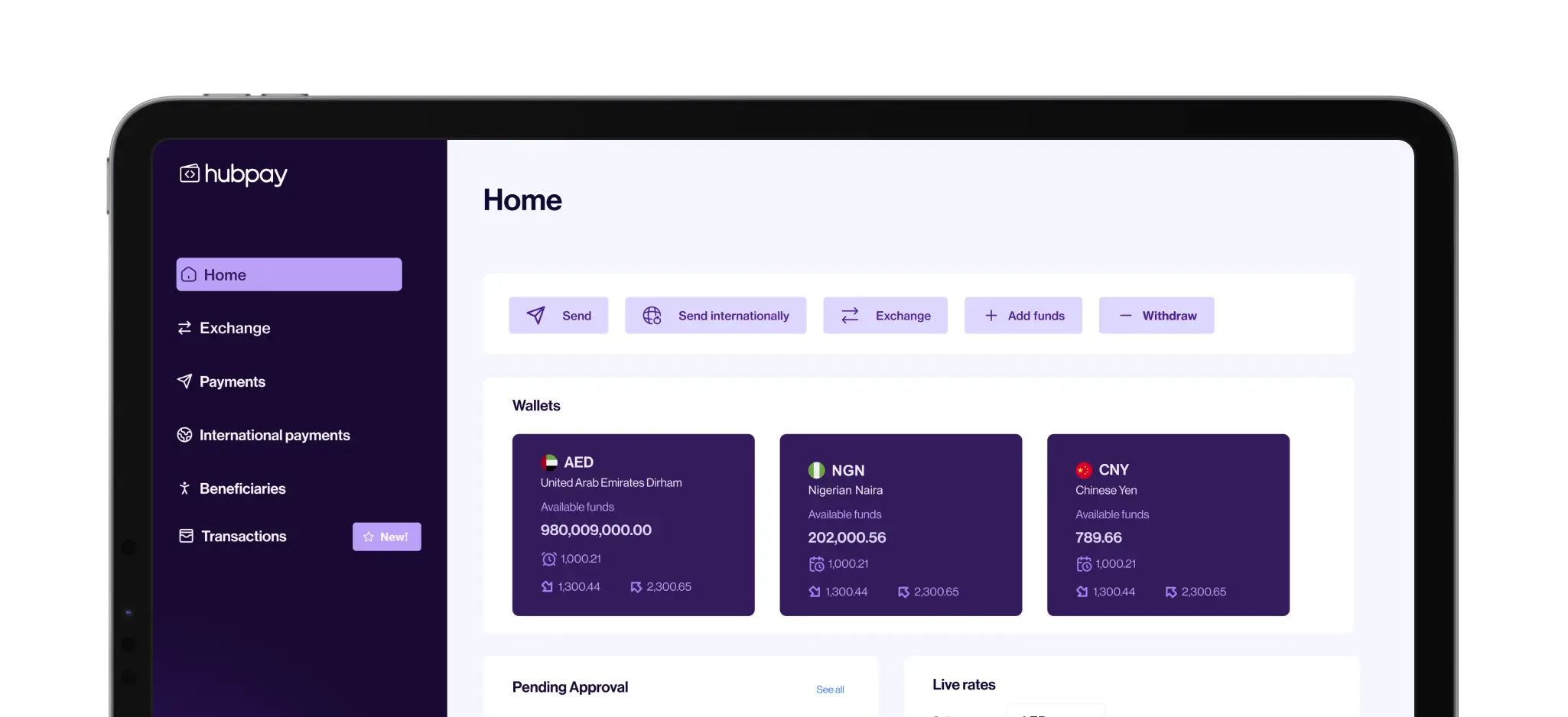

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.