Virtual IBAN for UAE Businesses: Fast, Secure & Global Payments

Access Virtual IBAN for UAE businesses in 50+ currencies to simplify global payments, cut costs, and speed up transfers with Hubpay’s secure solution.

Published on 10 April 2025

4 minutes read

Tired of waiting months to open a multi-currency account? You're not alone, and there’s a faster way forward.

Virtual IBAN for UAE businesses are transforming how companies manage multi-currency payments in today’s global market. For many UAE businesses, dealing with traditional banks means waiting up to six months just to open a dual-currency account, often with strict minimum balance requirements. That slows everything down.

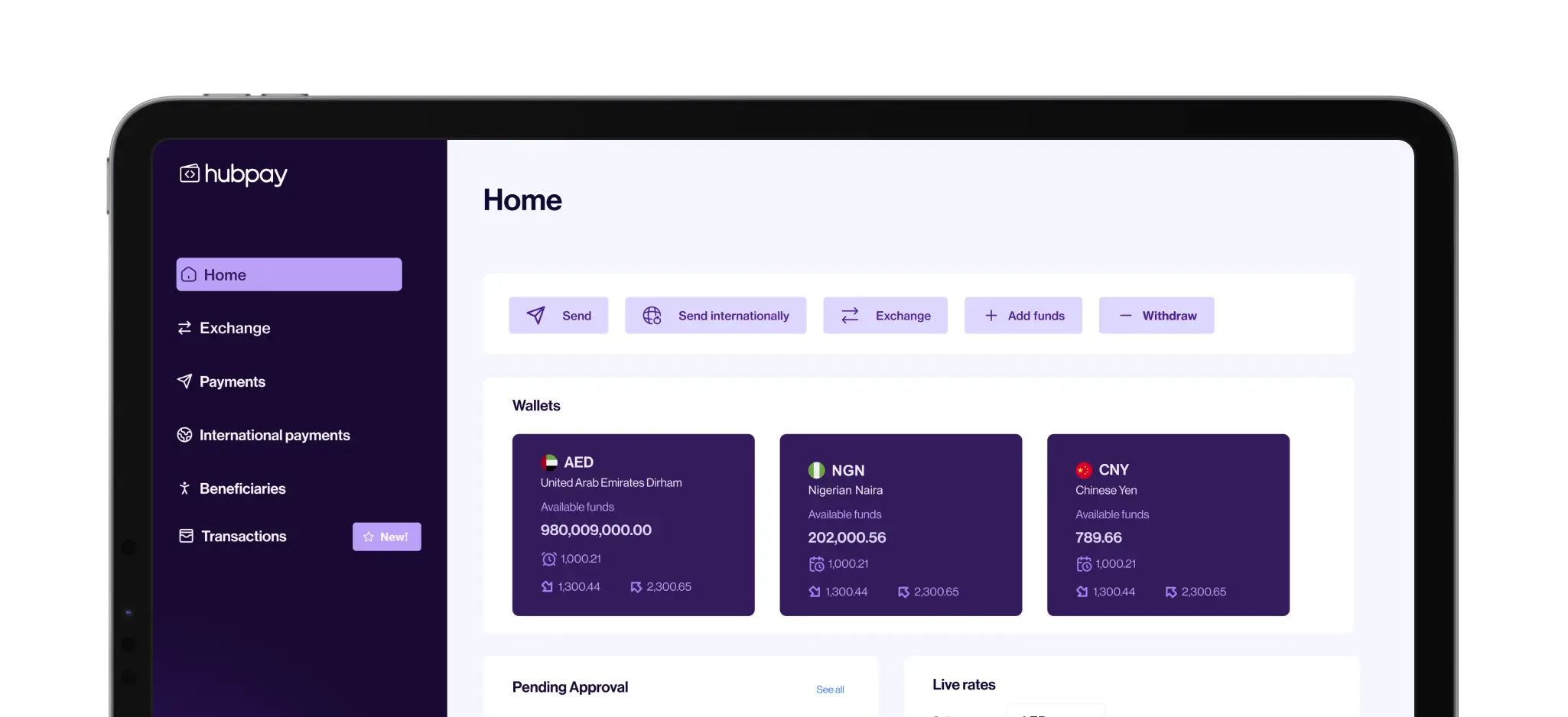

With Hubpay’s Named Virtual IBANs, businesses can access dedicated accounts in EUR, GBP, JPY, and other major currencies without the delays or red tape. Funds can be received and stored in wallets under your business name, without being forced into immediate FX conversion.

This gives UAE businesses total control, allowing them to convert when the exchange rate is in their favor and protect their profit margins.

In this post, we’ll explain how virtual IBANs work, why they matter, and how Hubpay helps UAE businesses simplify global payments and scale with confidence.

What is a Virtual IBAN and How Does It Work?

A virtual IBAN for UAE businesses gives you a unique account number to receive international payments directly in your business’s name without the need for local bank accounts in every country. Unlike traditional IBANs, which are tied to physical bank branches, virtual IBANs route funds through a centralized system and instantly reflect them in your account.

This allows you to operate with multiple currencies under one roof. Whether it’s USD, EUR, GBP, or JPY, you can receive, hold, and manage funds from global partners, all from a single dashboard. It simplifies reconciliation, reduces payment errors, and eliminates the need for multiple banking relationships.

Why Virtual IBAN Matter for UAE Businesses

Cross-border payments have long been a bottleneck for UAE businesses. Local banks typically impose high fees, unclear FX rates, and delays in settlement. A virtual IBAN for UAE businesses removes those friction points by giving companies a faster, more transparent alternative.

You get paid directly in major currencies, bypassing intermediaries and conversion losses. Whether you're exporting goods, offering global services, or managing revenue from international platforms, virtual IBANs ensure faster access to funds and better control over exchange timing, helping you protect margins and improve cash flow.

Hubpay’s Virtual IBAN for UAE Businesses

Fast, Flexible, and Built for Global Growth

Going global doesn't have to be complicated and Hubpay’s virtual IBAN for UAE businesses proves it.

With one account, you can send and receive payments in AED plus all major G10 currencies, including USD, EUR, GBP, JPY, AUD, and more. No need for multiple bank accounts or lengthy paperwork.

Hubpay provides a dedicated, named virtual IBAN under your business name, making it easier to receive payments from around the world. Account setup takes just one working day, transfers are faster, and fees are kept to a minimum. You also gain real-time visibility and full control over every transaction.

Whether you’re paying overseas suppliers or collecting revenue from international clients, Hubpay’s platform simplifies the entire experience. Built for today’s fast-moving businesses, Hubpay offers a secure, scalable alternative to outdated banking systems giving UAE companies the tools to grow globally with confidence.

Key Benefits of a Virtual IBAN for UAE Businesses with Hubpay

Hubpay’s virtual IBAN for UAE businesses comes packed with features designed to streamline global finance from day one.

Your business account is ready in just one working day, no long waits or complex onboarding. Once you're set up, you can manage payments across over 150 currency pairs and all major G10 currencies, directly from your Hubpay wallet.

Need to send USD to a supplier or receive EUR from a client? It’s seamless. Hubpay makes both local and international transfers quick, transparent, and easy to track.

For UAE businesses with overseas teams, Hubpay also offers non-WPS international payroll, allowing you to pay global staff without the costs or delays of traditional systems.

And if you're operating in the digital economy, you’ll appreciate Hubpay’s regulated crypto payment option, enabling you to accept crypto and instantly convert to stablecoins like USDT, all while staying compliant with UAE laws.

It’s more than a payments tool, it’s a gateway to efficient, flexible, and future-ready financial operations for UAE businesses going global.

With Hubpay, your virtual IBAN becomes the gateway to faster, smarter global finance.

Solving International Payroll with Hubpay

Managing payroll for overseas teams is a growing challenge for many UAE businesses. Traditional payment systems are often slow, costly, and hard to control. WPS only supports local salaries, so businesses with global staff need a smarter alternative.

That’s where Hubpay IBAN services come in. With a virtual IBAN for UAE businesses, you can send international payroll quickly, without using WPS. Your team receives the right amount, on time, in their local currency.

There are no hidden fees or long delays. You can manage everything in one platform and track each payment with ease, streamlining cross-border payments UAE for payroll purposes.

This makes it simple to support freelancers, contractors, or full-time staff abroad. As one of the most trusted UAE fintech solutions, Hubpay helps you save time, reduce costs, and stay fully compliant, all while giving you more control.

Crypto Payments and Virtual IBANs: A Future-Ready Combo

The UAE is fast becoming a global hub for regulated crypto services, one of the leading UAE fintech solutions making waves internationally. Many businesses now want the option to accept crypto and settle it securely.

Hubpay supports this shift. As the first regulated provider in the UAE, Hubpay lets you accept crypto payments and convert them into USDT, a stable digital currency. This adds more flexibility to how your business gets paid.

When combined with Hubpay IBAN services, crypto becomes easier to manage. You can settle payments faster and with full transparency using your virtual IBAN for UAE businesses.

This is ideal for businesses working with global clients or operating in the digital economy. With Hubpay, you stay ahead while staying fully compliant.

Final Thoughts: Power Global Growth with Hubpay

Managing global payments shouldn't be slow, expensive, or complicated. A virtual IBAN for UAE businesses gives you the speed, visibility, and control needed to thrive in cross-border commerce and Hubpay brings all of that together in one smart platform.

With Hubpay, your business can open a multi-currency account in just one day, send and receive funds globally, manage international payroll, and even accept crypto all from a single dashboard built for today’s modern UAE companies.

Whether it’s payments, payroll, or FX, Hubpay is the all-in-one financial solution designed to help UAE businesses move faster, smarter, and globally.

Discover how Hubpay supports smarter payroll and payments and get started today.

Frequently asked questions

Open a free multi currency account with Hubpay

We help companies all around the globe to send money in the easiest and cheapest way using multiple currencies. Talk to Hubpay Corporate FX team today

Share this blog on

Get your free multi currency account

Multi-currency global account made for UAE Businesses. Get a free consultation for your business.